Value Added does not receive attention

In a recent blogpost, the term Value Added (VA) was used. It defines the difference between the net income from the sale of products and services and the total purchase cost to the seller of materials and service inputs used to make the item. It is a measure for your organisation’s supply chains.

Unfortunately, VA is not found in the traditional structure of the Income Statement or Profit & Loss (P&L); they are designed for use by external investors, banks and tax authorities; not operational managers.

In traditional accounts, the P&L statement gathers together all the sales-side income and expenditure under the sales and administration headings; the supply-side expenditure is grouped under the general heading of ‘cost of goods sold’ (COGS).

Using this approach, it is not immediately evident which expenditures have been incurred to purchase materials, components and products, or for service contracts with Logistics Service Providers (LSPs). Consequently, sales revenue and net profit continue to be viewed as the most important line items.

Reporting by the financial media also emphasises sales and net profit (or net income). In addition, sales per employee and output per hour may be discussed. These latter measures reflect the extent to which a business is buying or making their goods and services. If a business has outsourced functions, the increased purchases result in the same or higher sales from fewer employees, but less value is added within the business.

Outsourcing functions to contract businesses has been a common approach to (hopefully) reduced costs, by removing functions or tasks from a business (taking them ‘off the books’). Of course, the costs have not disappeared; instead, they move from being an internal cost to a purchase cost.

Outsourcing of functions and contracting out tasks is a valid business decision. But, a business should not be considered as ‘better’ because sales per employee or output per hour have increased.

Value Added used in your business

Calculating the VA within a business is very important because, once identified, management is able to view where the VA was spent. This provides a picture of the business for management, but also for all employees, as it does not require accounting knowledge to follow.

VA is applicable in any organisation where value is added through one or a combination of: material conversion, assembly of components, distribution, post-sale services and technical or advisory services.

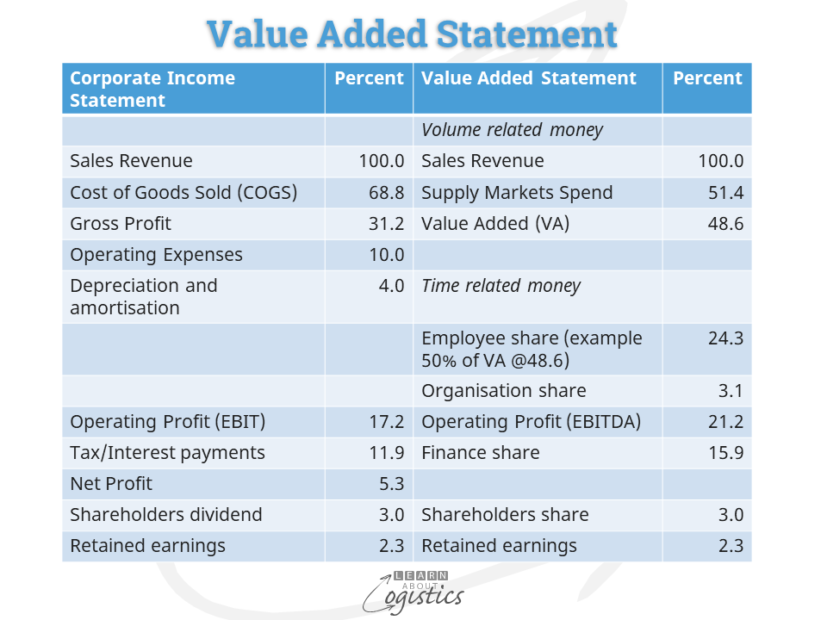

The table above illustrates an outline of the traditional P&L statement structure and the structure which highlights the VA of your business (essentially the supply chains).

In the VA column, ‘volume related money’ commences with the ‘sales revenue’, which become the ‘net sales revenue’ after paying royalties, commissions, sales tax, import duties and allowing for bad debts. The supply market spend identifies all external purchases of materials, component parts, products and services. The difference is the VA.

The VA is available to pay the time related money – employing people and operating the business, leaving a surplus from which to pay taxes to the government, dividends to shareholders and providing money to re-invest in the business.

To provide a saleable product or service in your business is through people changing the form of materials and services. Using their imagination, skill, time and energy, people utilise the capital resources at their disposal – land, buildings, machines and money. An old saying is ‘only people add value; technology reduces costs’.

‘People costs’ are shown in the diagram as 50 percent of VA (this is for illustration only). It covers the total cost of employing all staff (including senior executives). In addition to salaries and wages, there are payments for annual leave, superannuation (or provident fund) and employee benefits. Examples of these are: company cars, travel allowance, baby creche, staff dining or meals subsidy and training. The ‘People cost’ figure can be shown as the costs of each group, including the Supply Chains group.

‘Organisation share’ is the company costs incurred to legally establish and maintain the business, such as registrations, licences, professional audit fees etc. ‘Finance share’ reflects the money paid to banks as interest on borrowings and to tax authorities. ‘Shareholders share’ is money paid to investors as dividends.

Benefits to your Supply Chains from VA

Identifying the supply markets spend on physical items and services and the total cost of Supply Chains group employees, provides the total Supply Chain costs in the business. Being available for senior management, it can help to change the perception of Supply Chains from a cost to the organisation to an investment in the effective relationship with external supplier and customer businesses.

This is a more strategic view that allows the senior echelon of the Supply Chains group into the boardroom. There, they can argue the merits of capital and operational improvements in supply chains against projects from other parts of the business.

Implementing the VA structure provides an added benefit. The ratio of VA per full time equivalent employee can be used as an overall performance measure concerning the ongoing (trend) capabilities measure of all employees in the business.

Publication of the VA measure also means that management does not have to use the ‘our wages are too high’ stories (which companies paying $1 per day in developing countries also say). Instead, management and staff can see who gains the various shares of the VA ‘cake’.

When staff wish to increase their share of VA, positive discussions can be held concerning the actions required to either increase the VA (increase prices or reduce total cost of ownership (TCO) of goods and services), reduce total people costs, company costs or the tax/finance share.

Get VA to happen

The challenge for supply chain professionals is to get this change to happen, as there are multiple challenges:

- the Supply Chain group manager (or of each function that constitutes the Supply Chain group) requires conviction that they can advocate for change (and preferably can speak in accounting language!)

- accountants like the way things are, which is acceptable to the board, so why change?

- the Finance director will most likely consider that supply chain professionals should not interfere in accounting matters

- software applications may not allow the inclusion of a VA structure as an addendum to the traditional P&L statement

‘We behave how we are measured’ is an old (but true) saying. VA can provide an improved measurement of your organisation’s supply chains and therefore change behaviour. However, achieving changes to accounting measurements, so that improvements can be better understood by all in the business, is likely to be surprisingly difficult.