A CEO’s ‘inner sanctum’

At a recent industry event, a panel member whose consulting business advises companies on Sales & Operations Planning (S&OP), spoke about the ‘inner sanctum’ of CEOs. This selected group of executives meets when there is a situation that requires decisions that can seriously affect the business. The panel member’s experience was that only in about 20 percent of businesses which are ready to implement S&OP will the senior supply chain professional be a member of the CEO’s ‘inner sanctum’. For other businesses, the percentage is a lot lower.

He noted that the most common criteria for acceptance in the group was the ability to talk about supply chains in financial terms – not necessarily qualified in the discipline, but able to discuss matters in the language of finance and accounting.

Selection to the ‘inner sanctum’ is also easier if the senior supply chain professional is responsible for the Supply Chains group; at least comprising Procurement, Operations Planning and Logistics. This means that Flows of items through the supply chains and their related processes are more likely to be coordinated with Marketing & Sales and Manufacturing through the S&OP process, to provide Availability of products for customers.

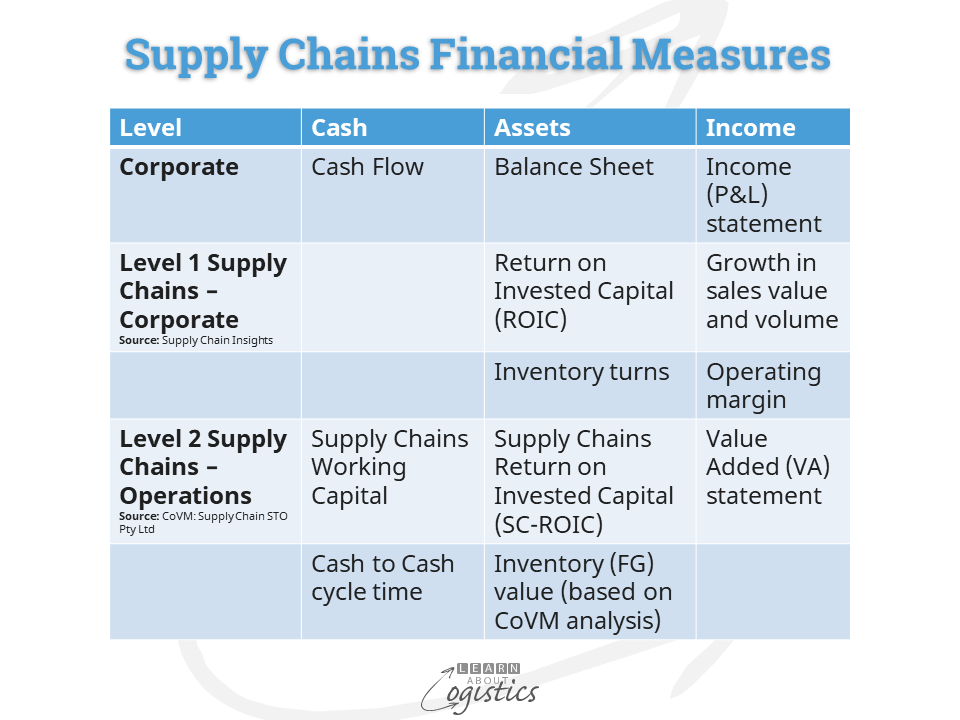

Corporate financial statements

The financial statements of a business (Balance Sheet, Income (Profit & Loss) and Cash Flow) report historical financial information. These statements are prepared for the Board of Directors and CEO of a business and for use by external stakeholders, finance executives and the organisation’s senior management. The corporate financial statements are not designed to provide an understanding of operational performance within an organisation’s Supply Chains.

However, within the financial statements there are elements where the performance of an organisation’s supply chains can influence the corporate results. Work has been undertaken for many years by the research firm Supply Chain Insights to provide an analysis of Supply Chain Metrics using published financial reports, for listed American public companies.

The analysis and index is based on “corporate financial performance, removing subjectivity from the decision process” which compares “peer groups operating in the same industries with similar

challenges and opportunities present within the business environment”. The four metrics used are:

- Growth is shared with Marketing & Sales in that Supply Chains provide Availability of product

- Operating Margin is calculated using Cost of Sales/Cost of Goods Sold (COGS), in which the supply chains have influence

- Inventory Turns is an overall measure of performance concerning the amount of inventory achieved to service customers under current operating conditions

- Return on Invested Capital reflects the level of investment in assets, of which supply chains can provide a substantial amount

Consider this approach as ‘Level 1’ Supply Chains – Corporate Financial Statements. They can be adopted by businesses in any country that wish to evaluate the financial performance of their Core supply chains, using Corporate financial statements. Actively using these measures can assist Supply Chain professionals to gain access to their CEO’s ‘inner sanctum’.

Financial measures at the Operations level

However, the measures identified and used by Supply Chain Insights do not consider the potential of financial performance measures at the Operational level. Using and publicising Operations financial measures that provide additional support for the ‘Level 1’ measures, can secure a position in the CEOs ‘inner sanctum’

Learn About Logistics calls this ‘Level 2’ Supply Chains – Operations Financial Performance as shown in the diagram below.

‘Level 2’ Supply Chains – Operations Financial Performance measures

Supply Chains Working Capital: Activities of the Supply Chains group support business relationships with suppliers and customers, which have a direct role in the timely collection and payment of cash. Responsibility for this element of Working Capital allows the Supply Chains group to make a range of

decisions and improvements to meet the objective.

Supply Chains Working Capital identifies the amount of short-term cash required and is traditionally structured as: inventory value + accounts receivable – accounts payable. To present a realistic picture within the Supply Chains Working Capital statement, the Inventory Holding (or Carrying) Cost should be calculated as a financing cost and then incorporated.

When an order is placed with a supplier, it established an obligation to pay. By raising a purchase order, cash will be allocated, which means that the purchase order amount should not be available for ongoing operations. However, the corporate Cash Flow metric encourages organisations to delay payments to suppliers, because doing so improves the corporate Working Capital position. But using suppliers’ funds to even partially finance an organisation’s business is damaging to the overall success of its Supply Chains.

The revised Supply Chains Working Capital statement is structured as:

inventory value + accounts receivable + cost of holding inventory (inventory value * inventory holding costs) + accounts payable

Cash to Cash Cycle Time (also called the cash conversion cycle (CCC)): is the Working Capital performance measure. It maybe available in your ERP system or can be structured as a spreadsheet. It determines the days of cash required to fund ongoing operations – the investment in inventory, providing credit to customers and payments made for purchases. Due to differences in how industry sectors operate, organisations will have different cash to cash cycle outcomes.

Value Added (VA) Statement: is reformatted from the corporate Income (P&L) statement to reflect the money spent with suppliers and the value added to these purchases by the organisation. Value Added (VA) is volume related and is calculated by deducting the Supply Markets spend from the net Sales revenue (revenue after paying royalties, commissions and allowing for bad debts). The VA is available to pay the time related costs of the organisation – employees, organisation, finance and shareholders. Importantly, the Value Added (VA) statement assists in building the perception of the Supply Chains group as an investment in supplier and customer relationships.

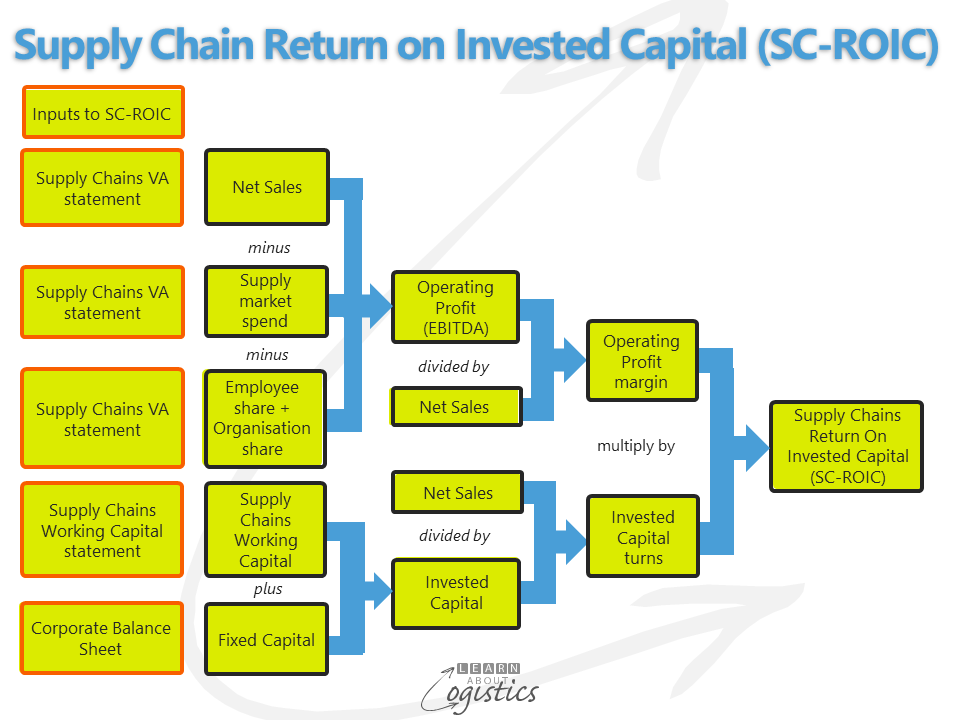

Supply Chains Return on Invested Capital (SC-ROIC): uses the Supply Chains VA statement and incorporates the measures of Supply Chains Working Capital and the Operating Profit (EBITDA) shown in the diagram. As with other Supply Chains financial measures, the absolute SC-ROIC value at a point in time is less important than the trend.

Inventory (finished goods) value (based on CoVM volume analysis): the calculated value is structured in a spreadsheet and measured against the actual finished goods inventory and actual Stock Turns

The three levels of financial statements provide a comprehensive picture for management of an organisation and its Supply Chains. This approach can be used by your organisation to measure the financial performance of the Core supply chains and as a starting point for change and improvement.