Be noticed at board level.

To ensure the board of directors at your business take notice of Supply Chains and Logistics, the board must review financial performance measures that are the responsibility of the supply chain group. The most applicable measures are: cash flow, working capital and return on investment (ROI). Of these, working capital and its derivative, the cash to cash cycle is the performance driver most likely to get logistics professionals noticed.

Cash flow is not recommended because it is already part of the financial reporting process. ROI (structured as the strategic profit model or DuPont chart) is a useful measure, but even though it has been in textbooks for many years, it is not commonly built into ERP software applications. It therefore requires the purchase of an application or work with an Excel spreadsheet.

Working capital is the measure because it is a measure of time – the longer a process takes, the more money is consumed by the business. And, while the objective of logistics is to provide availability, items must be supplied in the most effective time frame for the business and its profitability. The second reason is that the data is available from current accounting systems.

Working capital is the money invested in the operating processes, to buy, make, move, store and sell items. It comprises:

- Cash plus

- Inventory plus

- Accounts receivable (A/R) less

- Accounts payable (A/P)

The performance of working capital is not just about finance. Poor financial performance is a symptom of failings in business operations, such as the:

- credit management process

- collection of money from customers

- invoice dispute resolution process

- management of inventory and planning of operations

- ineffective sourcing and

- relations with suppliers

And the source of these failings can often be found in the policies and processes of the supply chain and logistics group.

Another reason for working capital to be the responsibility of supply chains & logistics is managing the business relationship consequences of financial decisions that maybe taken in isolation. For example, where in the supply chains will inventory be located, in its various forms and functions and financial liability occurs? Also, the potential effects, both immediate and longer term, of a decision to extend the typical supplier invoice payment terms of net 30 days.

The late receipts of payments by a supplier affects their cash flow. If not able to secure additional funding, the typical solution is to try and extend the payment terms for their suppliers. However, it is usually just the smaller businesses that must comply. However, if they supply critical items and become bankrupt, the effect can quickly go through supply chains; especially those operating in a ‘just in time’ (JIT) environment. As a general rule, if 10 percent or more of accounts payable in a business take longer than 45 days to be paid, that enterprise has a policy of using supplier’s money to help fund its business.

Managing working capital and optimising the operations of the core supply chains are two sides of the same coin. It is therefore preferable they be managed and measured as one entity and that is the role of supply chains and logistics. The measure to use is the Cash to Cash cycle.

Cash to Cash cycle

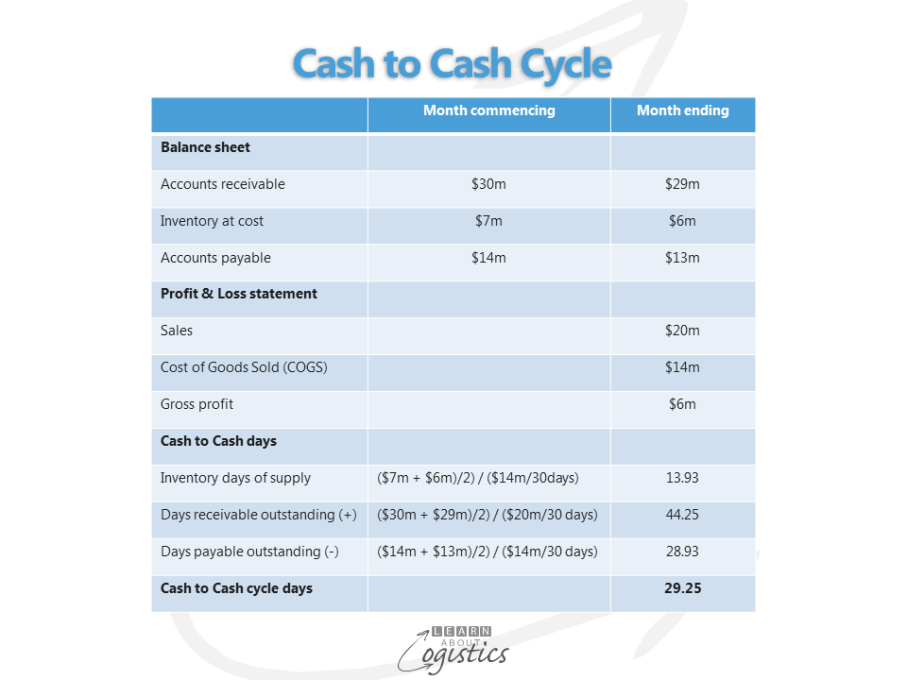

The measure identifies the time that operating capital (that is cash) is not available for use by the business. The calculation restructures the working capital calculation shown above, to identify the time it takes for cash invested in inputs to flow back into the organisation, following the sale of products and services.

The cash to cash measure is structured as:

- Inventory days of supply plus

- Sales receivable days outstanding minus

- Supplier payable days outstanding

This is shown in the following example:

Like most measures, do not view one result in isolation; instead consider the trend and before people get excited about the results, measure the standard deviation to show the variable results are ‘in control’. The objective to aim for is zero; that is zero inventory and the A/P and A/C receivable being equal. This is unlikely, because businesses established in different industries will have different cash to cash outcomes due to differences in how the industry operates. Supermarket chains can have between 10+ days (but can be a minus figure if the supermarket chain uses suppliers outstanding accounts to finance its business); consumer goods suppliers at 50+ days and tier one automotive suppliers 40+ days. If an independent benchmarking service exists in your country, the cash to cash measure for your business should be compared with other, similar business, so you know what competitors are achieving.

When there is a cash to cash story to tell, supported by operating numbers, you can then work within your business, with customers and suppliers to identify requirements, policies and processes that have the greatest impact on working capital performance. Projects can then be initiated to eliminate these impediments.

Approaches to consider are: move to a make to order (MTO) or assemble to order (ATO) operations model; improve information sharing between parties; review customer service processes to speed the collection of receivables; improve sales forecasting and distribution fulfilment. And, of course, review inventory not to just reduce it, but for the right balance between location, form and function.

Staff in your organisation (and hopefully the staff of other parties involved) should know why the project is happening and that a target reduced cash to cash cycle measure is the outcome. This has the potential to develop a more co-operative environment within your organisation and between parties in the supply chains.