Increasing industry concentration

Increasing industry concentration results in less competition among suppliers, which can lead to more distorted supply markets. This change in industry structure may well require Procurement to review and modify accepted practices.

A graphic provided in The Economist magazine compared the US market share of the largest four businesses for 893 industries, grouped into 15 sectors. The accompanying article reported that between 1997 and 2012, two-thirds of all corporate sectors in America had become more concentrated. Later commentary has indicated a somewhat similar situation in other developed trading countries.

Concentration within an industry is along a continuum:

- A monopoly is where one business controls the supply of an item that is unique and often covered by patents

- A cartel (which in many jurisdictions is illegal), has a group of businesses actively colluding to distort a market. This is through price fixing; market sharing (bid avoidance, non-competitive bids and bid rotation between suppliers) and restrictions on market access.

- ‘Monopoly power’ has a few businesses that are able to exercise supply market power; called ‘oligopolistic’ behaviour. This is not a cartel, but by reason of only a small group of suppliers, they are able to influence the price, capacity and production volumes, investments and form limits on the entrance of new competitors

Other types of supply market power are:

- Government approved and regulated supply markets e.g. sea and airports

- Vertically integrated supply chains

- Suppliers that compete with their end customers in providing a finished product e.g. automotive replacement parts

- Suppliers which sell to all major customers, restrict product and supply chain improvement until all customers demand the improvement e.g. types of packaging offered in retail products

In addition to externally imposed distortions and restrictions on sourcing items, organisations can restrict their own scope for sourcing items due to:

- The supplier for an item may be specified by the end user, providing no flexibility to identify alternatives

- The design of the product specifies components and ingredients that are only sold by a monopoly or oligopoly

- Corporate rules direct Procurement to buy certain items from divisions and subsidiaries of the parent organisation

- The buyer is ‘locked-out’ from considering alternatives. This can occur when an incompatibility could occur between intermediate items e.g. service parts and computer software

Buying in restricted and distorted situations

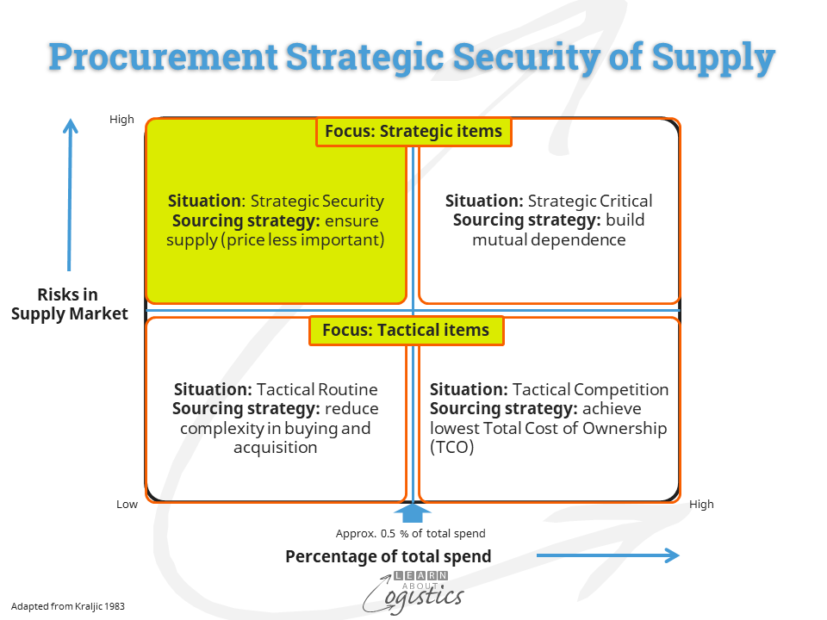

The previous blogpost discussed the use by Procurement of the Risk – Spend matrix. It provides a means of identifying buyer behaviour under different supply market scenarios. With the increase in supply market concentration, additional attention on this scenario can be useful.

The Risk – Spend matrix below concentrates on the limited competition situation (green quadrant), where restricted supply situations are likely to occur, but where Procurement must ensure supply. This is even though the item has a low percentage of the organisation’s ‘total spend’, but supply market and procurement risks have increased.

When market concentration affects items that Procurement deem as ‘Strategic Security’, there are actions which can be taken to improve the buying arrangement and provide some leverage for the buyer:

- Recognise that security of supply is more important than price

- The ‘three quotes’ competitive bidding approach to buying is not applicable as it assists monopoly power or cartel structures

- Build reciprocal relationships with suppliers with the objective to be open, trusting, helpful and productive

- Build a personal relationship with the sales person, emphasising reliance on their expertise

- Prepare for extended contracts (3+ years) with suppliers

- Potential to increase order volumes and therefore move business relationship into the Strategic Critical segment in the diagram

- Emphasise total cost of ownership (TCO) rather than price (which affects the supplier’s profit margin). Negotiate: risk sharing: price stability and variations, extended warranties; payment terms; consignment stock and technical support etc.

- Negotiate the supply of necessary add-on e.g. service parts and associated software within the capital contract

- Identify and improve impediments to supply of the item(s):

- Ordering process, receipt/inspection and payments

- Measure the performance of both parties

- Shape the supplier’s expectations

- Implement an Early Supplier Involvement (ESI) programme to ensure that restrictive supply conditions are avoided

- Work with the tier 1 supplier to understand the capabilities of tier 2 and 3 suppliers

Procurement tactics

If the relationship between the seller and buyer is not satisfactory, Procurement can implement additional tactics that may improve their leverage in negotiations:

- Additional research:

- Global market for the required items in the ‘strategic security’ quadrant

- Ownership and trading links between ‘competing’ suppliers

- Current or intended supplier

- Known and possible customers – items and volumes

- Likely sources and purchase costs for input materials

- Corporate structure and future investment plans

- Validity of a supplier’s patents

- Visit the current or intended supplier’s operations (if possible)

- The current situation with government and trade rules and regulations concerning the supply of an item. Also, how regulations may be legally circumvented

- Form a consortium with non-competing buyers to build leverage

- Negotiate as a group (if legal)

- Identify the ‘weak’ supplier in the group of suppliers:

- has lower sales and profitability, or is engaged in major change e.g. attention to new markets and products; major organisation change or mergers and acquisition (M&A)

- Negotiate with this supplier for the buyer’s total requirements for the item on a TCO basis

- Develop new suppliers with assistance and support

- Long term contracts (5+ years) to amortise investment in new equipment

- Loan of technical staff

- Financial: the purchase of dedicated equipment and tooling; direct investment; soft loans, early invoice payment terms

- Buying an item on the global supply market could lead to increased choice of supplier; however, the buying organisation must be structured for global sourcing

When Procurement has internal restrictions, they will need to liaise with the organisation’s stakeholders (senior management and interested parties e.g. design engineers and chemists) to convince them of a more beneficial direction for the organisation:

- Review the reasons why current specification have limits on possible suppliers

- Review the justification for intra-company supply of items

- Redesign products to avoid restricted supply of inputs

- Procurement to be involved in the process of drafting specifications – to identify the cost/benefit of supplier options

Distortion of supply markets could continue to increase in the future. Procurement and other supply chain professionals must therefore be aware of the increased risks and be prepared to approach supply markets in different ways (with senior management approval) to gain the initiative in negotiations.