Why consider supply markets?

The supply market for an important item should be the starting point for developing the sourcing strategy; identifying the potential effects on your organisation. This requires a comprehensive knowledge of relevant markets.

Analysis of a supply market can assist sourcing decisions through identifying:

- Constraints and potential threats related to an item, including trade influencing actions undertaken by governments

- The influence of financial markets, exchange rates and price trends on final product costs

- Security of supply issues, including conflict materials

- Potential alternative sources of supply

- Technology developments, including potential alternative materials

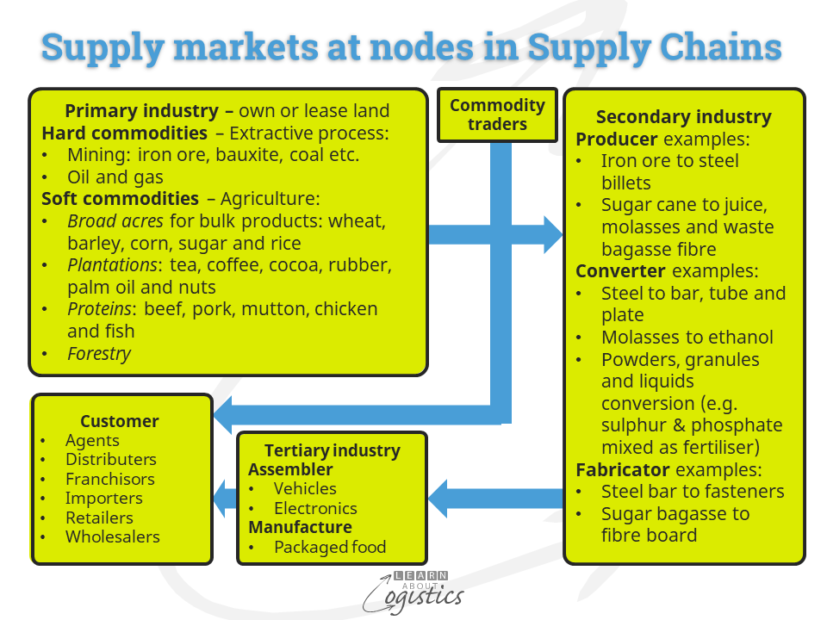

The diagram below illustrates the nodes (and associated links) where supply markets can exist in a supply chain. These markets are likely to be a mix of international and domestic organisations.

Knowledge of the structure and activities within the Extended supply chain (outwards from tier 2 suppliers) enables Procurement specialists to better negotiate effective contracts with Core (tier 1) suppliers. These can take account of market risks (including possible future delays caused by material shortage and transport bottlenecks) for the item and its materials.

Supply Market Analysis (also called Supply Market Intelligence (SMI))

A supply market for an item consists of all potential sources of supply to satisfy the needs of organisations and individuals. A Supply Market can exist for:

- A single class of commodity, such as iron ore or cotton

- Materials that are assembled or mixed into intermediate items such as semi-conductors, plastic resins and chocolate

- Services provided within a country or across borders

A supply market analysis for a material item or service commences with identifying the item to be analysed and the scope of analysis. Identify the classification code to ensure consistency:

- Publicly available market information is based on broad industry Standard Industry Classification (SIC) codes within a country

- An organisation’s sourcing activities are typically structured within specific item categories, which can be identified within the United Nations Standard Product and Service Code (UNSPSC) system (also through using the NATO industry code)

Data and information about supply markets exists in a range of sources:

- Public information

- Official government statistics

- Internet search

- Commercial information

- Market research and economic forecasting firms

- Reference databases and books

- Specialist magazines

- Chambers of commerce in specific locations

- Industry and public events

- Specialist conferences and seminars

- Visits to trade shows and industry fairs

- Supplier information

- Supplier’s annual report

- Suppliers promotion material and advertising

- Internal knowledge (mainly from Marketing and Sales and Procurement) – requires a market intelligence software application whereby data and information can be quickly entered and analysed

The value of the data and information should be graded by the confidence in its source:

- Government statistics in developed countries can be ranked high

- Commercial information that is paid for can be of good quality

- Internet based data is very variable

- Information gained at industry and public events or from suppliers can be less reliable

The information gathered in the overview is the basis for a three stage analysis process:

- Global, region and country factors that can influence a supply market:

- P.E.S.T.L.E (Political, Economic, Social, Technological, Legal and Environmental) structure. The six factors are interdependent and patterns of interdependence may be difficult to interpret

- Although typically used for end-user market analysis, this tool is applicable for analysing supply markets:. Note:

- Political and Economic trends will include trade influencing actions undertaken by governments

- Technology trends will include the availability of alternative or substitute products

- Although typically used for end-user market analysis, this tool is applicable for analysing supply markets:. Note:

- P.E.S.T.L.E (Political, Economic, Social, Technological, Legal and Environmental) structure. The six factors are interdependent and patterns of interdependence may be difficult to interpret

- Supply market for the item (identifying potential changes):

- Market structure and competition between suppliers:

- Monopoly: one seller and many purchasers

- Monopolistic competition: few sellers and many purchasers. Through emphasising product differentiation, the few sellers create an illusion of many sellers

- Oligopolistic: few sellers and many purchasers. Price is controlled by either an industry leader or cartel

- Oligopsony: many sellers and few purchasers

- Monopsony: several sellers and one purchaser

- Industry structure using the Five Forces (Porter 1985) approach can be used for supply markets:

- Supply market – competition between existing organisations:

- Growth potential of the industry

- Global diversity of competitors: geographical locations; location, ownership and operations of support and maintenance organisations for the item (if required)

- User markets and customers and relative importance of your country compared to other sales markets for international suppliers

- Capacity utilisation

- Price competition, drivers and trends

- Product differences

- Switching costs (fixed cost to customers from switching suppliers)

- Potential entrants to the market

- Possible reactions of existing suppliers

- Low cost country (LCC) entrants

- Cost of entry

- Product differentiation

- Alternative distribution channels

- Government policies

- Threats in the market

- Forward or backward integration by existing and new suppliers

- Demand fluctuations

- Supply limited by natural availability; production capacity and utilisation; supplier collusion

- Supply of materials, components or finished items for resale threatened e.g. the availability and price of lithium could affect the supply of end products, such as storage batteries

- Disrupting technologies or substitute products and services introduced

- Power of suppliers in negotiations

- Power of buyers in negotiations

- Supply market – competition between existing organisations:

- Market structure and competition between suppliers:

- Risk Analysis – identify the likelihood (probability) of the changes occurring, together with the possible consequences if the changes actually occurred

Implementing a new supply market analysis is a challenge, due to the scope and content in the exercise. While the initial analysis is a project, there should be an annual review process. It is unlikely that Procurement professionals will have the time to undertake this critical part of a Sourcing Strategy; therefore seek assistance on a contract basis from outside your organisation.

The skills required are an interest in enquiry, structuring data and information and persistence. These attributes can be found in retired

analysts and librarians and people who have engaged across industries such as procurement and sales.

The SMI process does not automatically reduce procurement risks. However, access to current information concerning supply markets does strengthen the negotiating capability of Procurement professionals with current and potential suppliers.