Why Supply Chain Financing

The past few weeks has seen articles in the media about ‘controversial’ Supply Chain Financing (SCF). This has occurred due to the collapse in the UK of a financial services company which provided this form of finance. But is SCF ‘controversial’?

Since the start of trading using money, the situation has existed where a seller wants to be paid quickly for their goods and the buyer would rather not pay until they have on-sold the items and received income. This provides an opportunity for a ‘middleman’ to provide the finance (for a fee) to the seller. And so ‘Financial Factoring’ became available.

In recent years, large corporations across various industries have implemented the idea that suppliers can be the ‘customers bank’. They have extended payment terms for up to 120 days, which suppliers cannot afford.

For the seller to be paid on-time, the buyer can use their credit rating to provides surety for a finance company to pay the seller and the buyer to pay the finance company over an extended period. This is ‘Reverse Factoring’. But, to have more sales appeal, finance companies called it ‘supply chain financing’ which, of course, should cover both Factoring and Reverse Factoring.

Due to the current problems with the UK financier, the challenge will be, that politicians may change the rules, to the detriment of businesses that could benefit from using financial services.

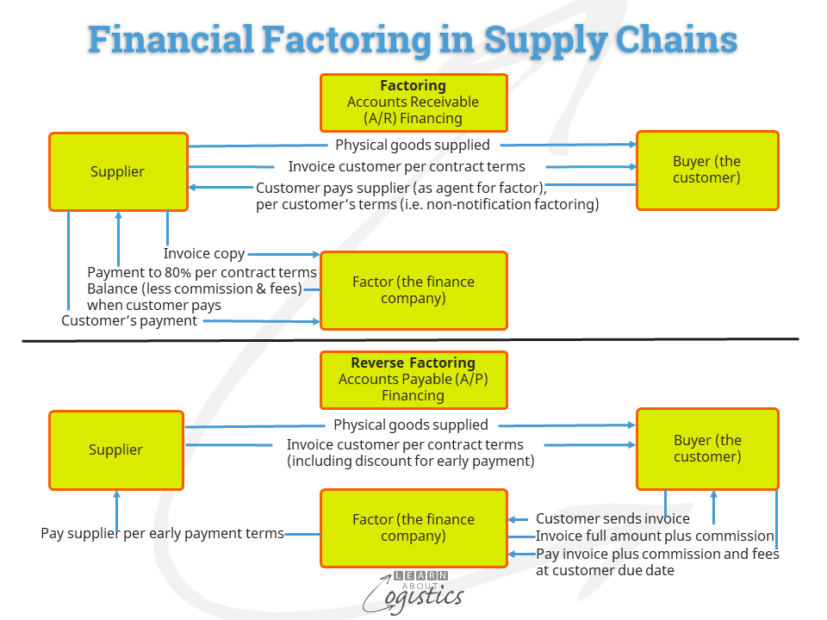

The diagram illustrates that Factoring and Reverse Factoring contain a flow of documents and money between three organisations,: the Seller, the Buyer (customer) and the Factor (the finance company). The flows are:

Factoring (A/R Financing):

- Seller provides goods and invoice to the Buyer

- Seller sends the invoice to the Factor. Typical trading terms by a seller are ‘net 30 days’ and in some situations have a discount for early payment e.g. ‘3 percent 10 days’

- Factor provides up to 80 percent of the invoice amount to the Seller at the specified date (say 30 days). The percentage depends on the term of the Buyers payment against the invoice

- Buyer pays the Seller, which could be up to 120 days from receipt of invoice. This is a ‘non-notification’ contract, where the Factor does not notify the Buyer concerning the change of ownership of the debt – the Seller acts as agent for the Factor. For a ‘notification’ contract, the Factor informs the Buyer concerning ownership of the debt and the Buyer pays the Factor

- Seller pays the Factor the full amount of the invoice

- Factor pays the balance of the invoice amount to the Seller, less commission and fees

In this process, the agreement between the Seller and the Factor is without recourse, whereby the Factor assumes the credit risk that the Buyer will not pay the invoice amount. An agreement with recourse requires the Seller to accept the risk of non-payment from the Buyer.

A variation on the factoring process is called ‘Invoice Discounting’. Here, the Seller assigns an Accounts Receivables balance (not individual invoices) to the Factor as collateral for a loan; however, the Seller remains responsible to collect their debts from Buyers. In the UK and some other markets, Invoice Discounting is considered another form of Factoring. In the US it is not.

Factoring is best suited to the needs of businesses that are growing at a fast rate. They require finance to buy an increasing amount of supplies, but without having a buying history that could allow extended payment terms from their suppliers. The amount of finance provided will vary, depending on the perceived quality of the specific accounts receivable, the debtor (Buyer) and industry. Ideally, the Seller should earn a return on investment that is higher than the rate charged by the finance company.

Reverse Factoring (A/P Financing)

- Seller provides goods and invoice to the Buyer

- Customer sends invoice to the Factor. Typical trading terms by a seller are ‘net 30 days’ and in some situations have a discount for early payment e.g. ‘3 percent 10 days’

- Factor pays Seller the full amount within the ‘discount for early payment’ period and retains the discount amount (this is called ‘arbitrage’)

- Buyer pays the Factor the full invoice amount, plus commission and fees, within the agreed payment period (say up to 120 days from receiving the invoice)

When a supplier must be paid quicker than the time taken to sell the items and collect the sales income, such as when building inventory for a seasonal sale, Inventory finance can be used. Here, the Factor uses the Purchase Order issued from the Buyer for items (typically finished goods) as collateral for a loan to cover the purchase of items.

A disadvantage of Reverse Factoring (A/P Financing) is the potentially low number of larger companies that use the service,; therefore the Factor has insufficient diversity to spread the financial risk. The risk for Buyers is default by the Factor (as has happened in the UK). If another finance company to take on the debt cannot be found, the Buyer is liable to pay the outstanding invoices, which could be a very large sum.

Through Reverse Factoring, the commercial terms available to the Seller becomes part of contract negotiation, as the Buyer attaches its higher credit rating to the Seller. The Buyer can negotiate aspects of the relationship concerning supply chain visibility and scheduling deliveries. In addition, where a Tier 2 supplier (the supplier’s supplier) is critical to the Buyer, there is potential to provide Reverse Factoring for that supplier. However, it is dependent on the supply chain using technology that Factors can rely on for visibility of orders.

Measuring supply chain group financial performance

Where the supply chain group (Procurement, Operations Planning and Logistics) has financial performance measures, the most applicable is Working Capital and its derivative, the ‘Cash to Cash’ cycle, which determines the days of cash required to fund ongoing operations. In addition, cash flow and return on investment (ROI) may be used.

Working Capital is structured as: current assets less current liabilities (that is: cash + inventory + accounts receivable – accounts payable). The inherent dilemma is that it encourages organisations to delay payment to suppliers, because doing so improves the corporate Working Capital position.

Future for Supply Chain Financing

As technologies for ‘track and trace’ of items are further developed and implemented, it should facilitate co-operation and co-ordination between the finance and supply chain functions of organisations.

Improved co-ordination will enable a better understanding of the payment dilemma. For buyers and accountants there is the pressure to extend the time in which to pay suppliers – often because the buying organisation has not been paid by its customers! At the same time, suppliers have limited access to money that will cover shortfalls in their collection of debts from buyers.

This will require solutions that speed the flow of data, information and money through supply chains. The third-party financial services provider (the Factor) is a necessary element, for which rules are required that help to build trust between Sellers, Buyers and Factors.