Disruption and the traditional approach

For reasons outside the control of individual organisations, supply markets are being disrupted and in some cases, distorted. Procurement professionals need to be aware of the potential concerning increased risks at suppliers (and where possible, their suppliers). The result will be different approaches to the various supply markets and suppliers.

In some industries, suppliers are dependent on purchases through that industry’s supply chains. The major buyers have exploited this and typically bought items from a position of power in the industry. However, as technologies and production processes change, power can realign, but large buyers continue to conduct business in the traditional manner. An example is in the automotive assembly sector.

Automotive industry supply of semiconductors

Engine controllers were the early electronics used in vehicles. There were only a few ‘commercial off the shelf’ products available from two major suppliers, which also manufactured the products. Since that time, the amount of electronics in use has increased substantially across many products. This has resulted in the total demand from the automotive companies now being less than 10 percent of the suppliers’ total annual sales. The automotive assemblers need semiconductor suppliers, but it is not the same in the opposite direction.

This situation will not change, even as electric and autonomous vehicles are introduced. Although they require many custom-made chips, the vehicles will be replacements for internal combustion engines, so the total market will not increase substantially.

An added challenge with the automotive electronic products is that they are designed and qualified against standards for durability and reliability, so designs are not regularly updated. Production is therefore on older generation machines, with total capacity relatively fixed, as production equipment is more difficult to acquire and is not interchangeable with new technology machines.

So, here is an impasse of cultures. The automotive companies (but apparently less so if based in Asia) have a ‘cost down’ approach to buying negotiations and expect a just in time (JIT) delivery of components. The chipmakers have a lead time measured in months and do not need the automotive business, therefore discussion about price are of low importance.

This situation is compounded, due to the era of outsourcing. The automotive companies now buy from tier one auto-parts suppliers that may contract the completed chips to be assembled by specialist contract companies. The tier one companies work with automotive semiconductor designers, but many of them only design the chips and technology; the chips are made in contract factories (‘foundries’), as are silicon wafers.

The extended supply chains meant that when automotive companies reduced their requirements due to the initial COVID19 related shutdowns, warnings that production capacity for semiconductors would be reallocated to other industrial sectors were not effectively communicated.

The likelihood of shortages were identified in Q2 2020, but the extent of the problem only came to light in Q4 2020. In turn, this resulted in shortages in the foundries – wafers, substrate materials and other discrete components. Without any surprise, this situation through supply chains is not new – it was first discussed in the early 1960s by Jay Forrester, in his book Industrial Dynamics, then in the 1990s when the Beer Game demonstrated Demand Amplification through the Bullwhip Effect.

The Category Management approach

To address incompatibilities between buyers and sellers, Procurement professionals need to differentiate items and suppliers through Segmentation of the supply base. This is done through the process of Category Management, which includes:

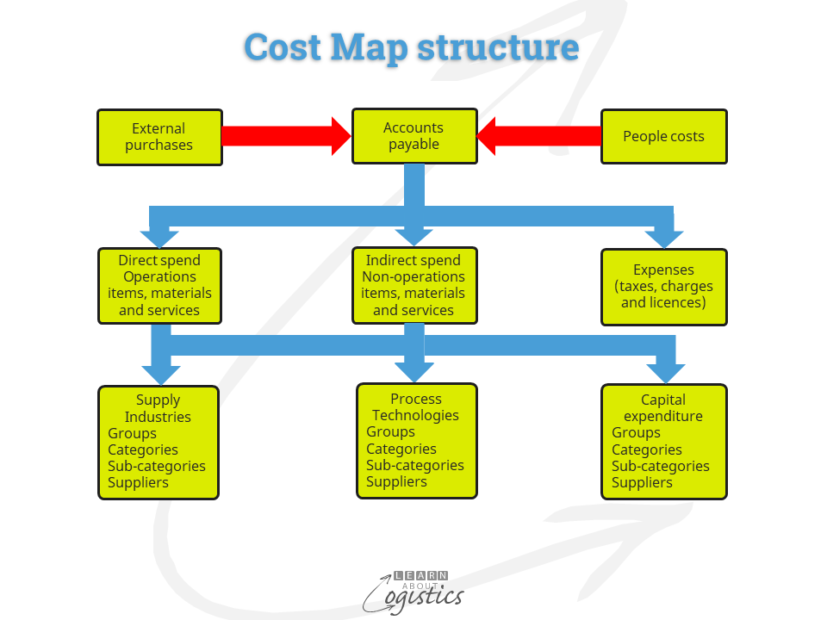

Category Analysis with input from the ‘Cost Map’ of expenditures and suppliers, allocate purchased items into categories and sub-categories under headings of Supply Industries or Process Technologies. For example:

- Within ‘supply industries’, there is the Automotive Electronics group

- A category is named Semiconductors

- Four sub-categories are: microprocessors, memory chips, commodity integrated circuits and complex ‘systems on a chip’.

Process technology groups are: IT and telecoms; Logistics services; Travel and entertainment; Facilities etc.

- A process technology group is named ‘Facilities’

- A Category within this group is named ‘Industrial supplies’

- One of the sub-categories is named ‘Safety glasses’

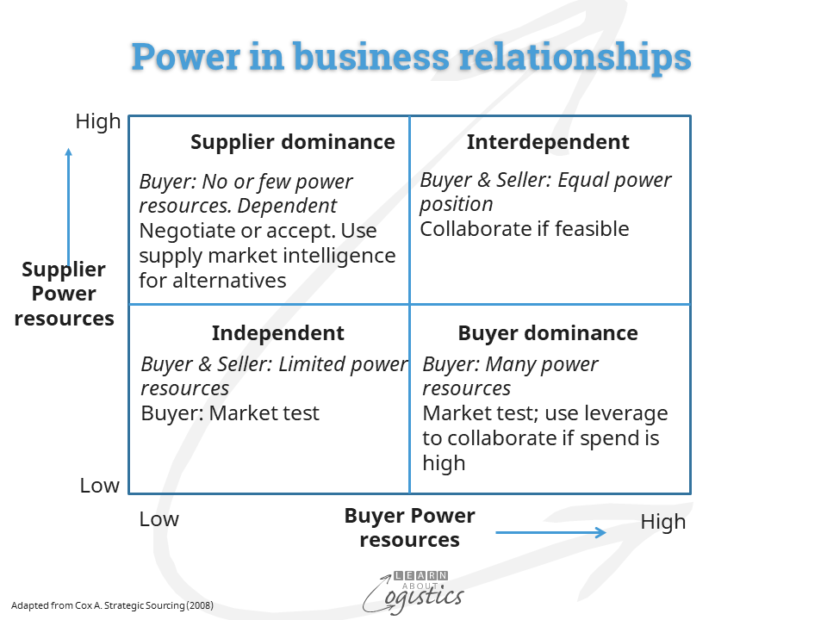

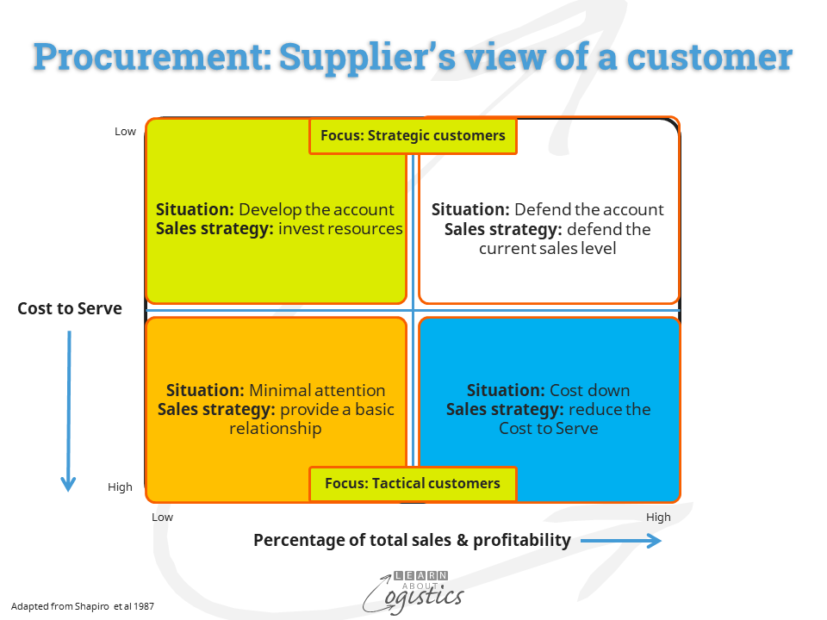

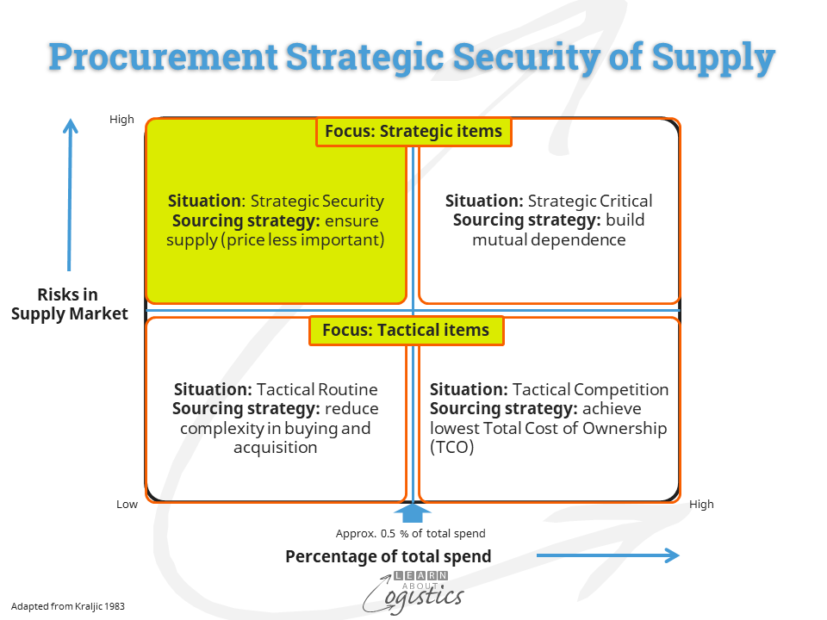

Spend Analysis includes the ‘Risk-Spend Positioning’ matrix (which addresses Power and Dependency with suppliers) and the ‘Supplier’s View of the Buyer Organisation’ matrix.

When Category and Spend analysis are linked, they provide the ‘Supplier Capability and Relationships’ outline for a category, sub-category or an item that answers three questions:

- What and how much do we buy?

- From whom do we buy and why?

- The risks associated with the buy

The risks associated with an item should be identified under the headings of::

- External risks: arise from interactions between a supply chain and its wider environment

- Supply network risks: within the inbound and outbound supply chains, including suppliers and customers

- Internal (enterprise) risks: related to potential uncertainties in the execution of the organisation’s supply chain strategy

- Supply chain process risks: identify an inability to achieve consistent outcomes relating to planning the movement and storage of materials and resources and deliveries of products or services:

- Risks within Procurement

- Risks within Operations Planning (including subsequent Quality and OH&S risks)

- Risks within Logistics

In the semiconductor example, some supplier risks for automotive assemblers are:

- Demand from all automotive companies is less than 10 percent of sales by semi-conductor businesses

- Items are low in total spend, but critical to the sale of vehicles, as demonstrated by the current shutdown of auto-assembly factories

- Lead times for semi-conductors longer than auto-industry expectations

- Shortage of supplier capacity due to older style design. Additional capacity difficult to source

In the ‘Supplier View of the Customer’ matrix below, auto-assemblers would be located as ‘Tactical minimal attention’, as sales are low and the Cost to Serve is likely to be high. Given the percentage of total sales will not dramatically change, semi-conductor suppliers will be looking for a reduction in the Cost to Serve.

However, using the Risk-Spend matrix below, automotive companies should position semi-conductor suppliers in the Strategic Security quadrant – purchases are low, but the item is critical.

These two diagrams illustrate the challenge for automotive companies to engage with and better understand the needs of suppliers. This may result in changes to the specification and design process, the placement of longer term contract volumes to allow better production planning, with call-up of items against the plan and a reduction in the emphasis on price – guarantee of supply is more important.

For improved Procurement outcomes, the Category Management approach is the process that Procurement professionals should adopt to structure a better visibility of their supply base.