Supply Network Risk Management

The COVID 19 pandemic and disruptions to supply chains has provided an opportunity for organisations to review the effectiveness and inherent risks of their supply chains and the suppliers within them.

The review is undertaken by senior management, providing their input concerning the corporate approach to supply chains. The review should consider the:

- Trade-offs between the responsiveness required of supply chains, the increasing breadth and depth of product lines and inventory costs

- Extent of resilience required against disruptions in the organisation’s supply chains, including at suppliers and 3PLs

- Visibility required through the supply chains

- Cost-benefit of ‘Just in Time’ (or Lean) vs ‘Just in Case’ in supply, manufacturing and delivery

- Viability of the current approach to global sourcing – to source from local and international suppliers, based on material availability; people knowledge and capability; production costs; delivery flexibility and transport costs. Consider geographical diversity of materials and suppliers; off-shoring vs on-shoring and near-shoring

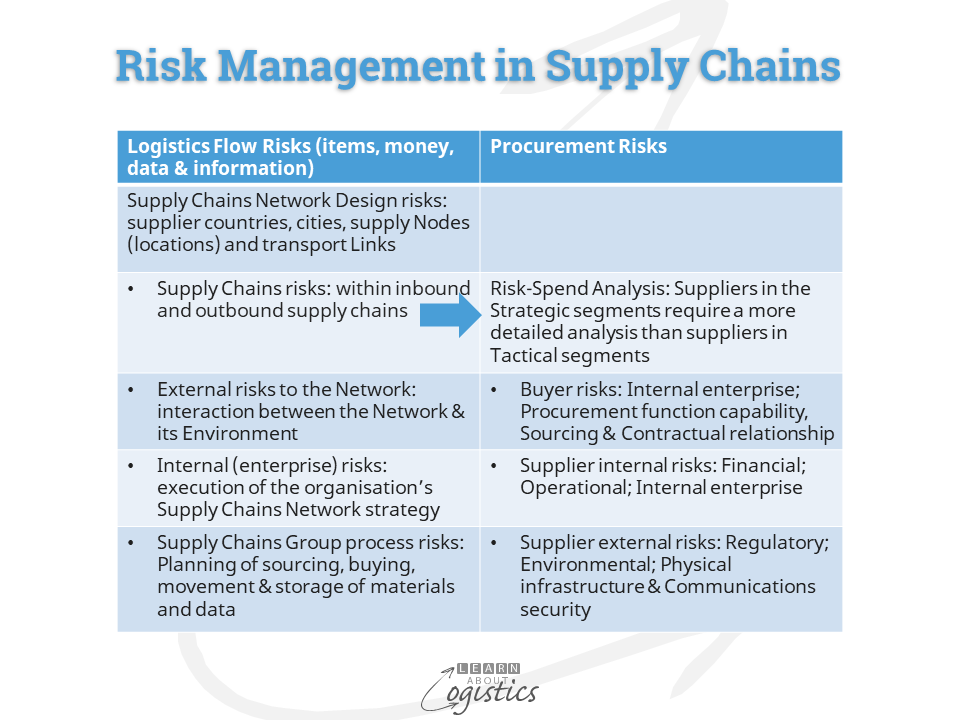

The decisions from this corporate review and the maximum capital expenditure (CAPEX) to achieve them, provide input to the Supply Network strategy. The review also provides parameters for supply chain professionals to use in an analysis for the two main elements in Supply Network Risk Management:

- Risks to flows of items, money, data and information through each supply chain of the network

- Risks at each supplier, especially strategic (therefore critical) tier 1 suppliers

The table identifies the main headings for each element. The risks to flows in the Supply Network were discussed in an earlier blogpost This blogpost discusses Procurement Risks. When using the following list of Procurement Risks, the main bullet points identify the possible risks and the indented texts are factors to consider in analysis of the particular risk.

Buyer risks

Internal (enterprise) risks:

- Performance – the purchased item will fail to perform as required

- Social – the purchased item/supplier does not meet with approval by internal stakeholders, including Procurement peers

- Economic – expenditure loss from an unwise purchase

- Brand – quality, environmental and labour hire problems at suppliers can damage a company’s brand (and cost money)

Procurement function risks:

- Design and implementation of the Procurement Strategy and Procurement Risk process (within the corporate Supply Network Risk Management regime)

- Expertise and skills of Procurement staff and staff turnover:

- Management of multiple and concurrent supply challenges

- An understanding of global supply markets

- Communication channels with the supplier

- Travel hours between buyer and supplier

- Stability of design, specifications and technical documentation

- Extent of ‘sole source, single location’ or ‘single source, multiple location’ suppliers

- Provision for replacement parts based on ‘mean time between failures’ (MTBF) measure. Minimum production quantities and ‘all time buy’ near end of life (if required)

Contractual relationship risks:

- Power which can be exercised within the contract between buyer and supplier and between the supplier and its suppliers

- Dependency of supplier on the buyer

- Capability of supplier when affected by a supply chain disruption

- Total cost of ownership (TCO) to the buyer

- Cost/price rise and fall expectations and acceptance by the buyer

- Willingness by supplier to provide breakdown of costs to buyer

- Allocation of risk and willingness of supplier to share risk and reward.

- Complementary or competitive interests with supplier

- Performance measurement format and performance management process

- Compatible national and organisation culture

- Skill sets at supplier to manage the relationship and communications channels

- Potential of change in the business relationship

Supplier Risks

Financial Risks:

- Supplier financial security and solvency

- Continuity of supply; cancellation or delay cost

- Credit

- For international suppliers: currency and exchange rate, country inflation, interest rates

- Intellectual Property: suppliers access to the buyer’s proprietary knowledge regarding design, technical operations/engineering and materials

Supplier Operational Risks:

- Capability of consistent supply (delivery in full, on time, with accuracy – DIFOTA)

- Manage many supply contracts from multiple buyers

- Supplier volume/capacity commitments

- Contract start schedule

- Capacity for start of deliveries

- Construction start-up schedule (if relevant)

- Manufacturing capability

- Cycle time adherence, set-up time reduction, preventative maintenance schedules

- Occupational Health & Safety (OH&S)

- Industrial disputes at supplier and their suppliers

- Delivery execution capability

- Increase to capacity (capability of)

- Time to allocate additional capacity (to meet buyer’s demand surge)

- Technology/product development lead times

- Operations planning capability

- IT&Communications planning and scheduling systems capability

- Inventory planning (for contract start and ongoing)

- Material and components lead times

- Supplier’s outsourcing and sub-contracting processes and security of supply

- QA control of the process

- Replacing critical staff

- Customer service escalation process

External Risks for a supplier:

Regulatory:

- Business regulations – extent and expectation of adherence

- Trade regulations effects (e.g. duties, dumping and political embargoes)

- Technical regulations effects (e.g. building permits, IT infrastructure integration)

Physical infrastructure:

- Modes of transport; sea and airports

Communications security:

- Cyber attack on supplier’s network and defence capability

Environmental:

- Effects of climate change on the supplier. Life Cycle Analysis (LSA) for the item(s)

Manage the risks

When contracting with suppliers, there will always be a level of risk to accept concerning deliverables and price; although some risks can be transferred (including through insurance). For the risks that are accepted, the objective is to reduce the likelihood of occurrence and reduce the seriousness of consequences if the risk occurs.

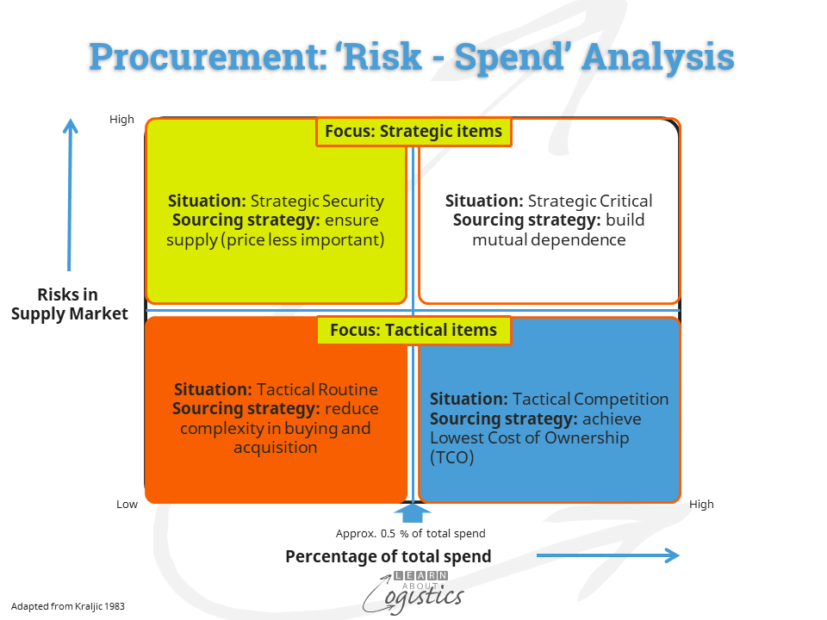

A previous blogpost provides an explanation for each quadrant in the above analysis and for the likely response of suppliers to an approach from the buyer.

For Tactical items, a portfolio approach to the risks can be used across all suppliers in each of the Tactical Routine and Tactical Competition sectors. For this approach, commitments are totalled by region, country, city and supplier. Across the portfolio, contracts are identified that could:

- compete for resources at suppliers and 3PL

- affect deliveries or potential obsolescence of other items

- be affected by transport modes and facilities (sea and airports) disruptions

With Strategic suppliers, the risks are higher, therefore the approach must be more focused. For Strategic Critical items, the sourcing strategy is to build mutual dependence and for Strategic Security is to ensure supply. For both, Procurement professionals need to consider how the risks in the relationship can be shared with the supplier or other parties e.g. sharing current assets rather than building new.

Recognising and measuring risks in Procurement is a step to improving your supply chains. It is also a step to managing Procurement within a Category Management structure.