Supplier’s assessment of a buyer

The past two years have highlighted that disruption to supply chains can come in many forms and may be inter-related. To mitigate the potential for disruptions that may seriously affect your organisation requires a close relationship with tier 1 suppliers. But how well do you know these critical suppliers?

Too often, buyers focus on assessing what a supplier can provide, when and at what cost. They can miss the important issues around capabilities and culture of the supplying organisation, which could help to overcome challenges in trying times. A question to ask within your Procurement team is “how does the supplier view the relationship”(actual or potential)?

To do this requires Procurement professionals to ‘get inside the mind’ of the supplier; see the world as they do and understand their perceived opportunities and threats. An honest approach to this analysis provides valuable information concerning how the supplier considers your business as a customer. Initial question that start the process are:

- Attributes of the buyer organisation – strengths and threats from the supplier’s perspective

- Buyer’s current (or proposed) annual purchases as a percentage of total annual sales and the potential increase or decrease

- Buyer’s current annual purchases from the supplier, weighted by the estimated gross margin, plus the ‘cost to serve’ your business e.g. added costs due to the buyers special requirements

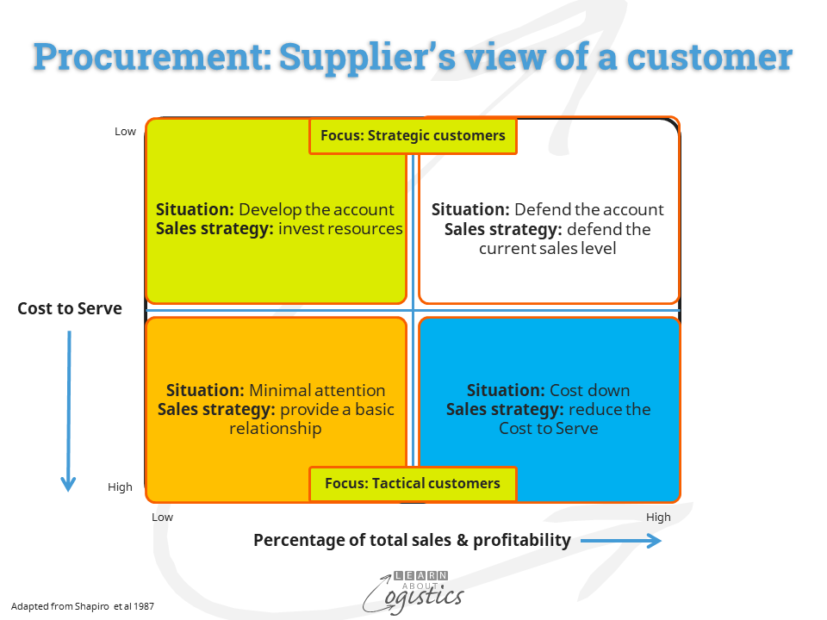

These answers assist with positioning your business from the supplier’s view, as illustrated in the diagram:

Quadrant 1 – Minimal attention: A low percentage of total sales, with a high ‘cost to serve’ Options available:

- Maintain a transactional relationship

- Close the account

- If the customer has a product in the early stage of development, with good sales and margin potential, develop the relationship to move customer profile to either ‘develop the account’ or ‘cost down’ quadrants

Quadrant 2 – Cost down. Annual sales acceptable, but ‘cost to serve’ is high. To do:

Work with customer to reduce the ‘cost to serve’

Quadrant 3 – Develop the account. The current percentage of annual total sales is low. The ‘cost to serve’ is also low. To do:

- Invest resources to develop the customer account

Quadrant 4 – Defend. High current sales as a percentage of annual total sales. Low ‘cost to serve’ To do:

- Defend the current sales position: maintain high service level; dedicated account manager; initiate discussions with customer concerning an alliance

Completing this analysis enables Procurement professionals to identify any mismatch with their needs that requires attention. As an example, a previous blogpost discussed the current apparent mismatch between buyers and suppliers providing semi-conductors in the automotive sector.

Assess a supplier’s organisation culture

While this analysis provides valuable insight concerning the current relationship, Procurement professional need to gather additional intelligence regarding the culture of the supplier’s organisation. There are a number of approaches to assessing organisation culture; an example is the 2012 book Fundamentals of Strategy, in which the authors Johnson G, Whittington R and Scholes K, provide a model of connecting factors that contribute to a work environment. The factors are:

Stories: events that people talk about inside the organisation. Also those that received external publicity (good and bad). These include stories from present and past customers about their impressions of the supplier. Stories provide an indication of the organisation’s values.

Rituals and Routines: the behaviour and actions of people in the organisation that indicate what is acceptable. These identify what is valued by management and the behaviours most likely to occur through the business relationship, such as how communications with customers are handled in a crisis situation. These provide some evidence concerning the strength of commitments given in negotiations.

Symbols: these are the outward signs of how the organisation presents itself to the outside world. Examples are, the visual appearance of premises (offices, warehouses and factories); presentation of staff (formal or informal dress codes), the layout and furnishings of offices space (open or closed). Involvement with charities and NGOs and statements and actions concerning climate change.

Organizational Structure: the formal organisation structure. Capabilities and motivation of employees, especially those in the supply chain group. Attitude of the organisation towards employees and their actual treatment. Is the supplier an employer of choice?

Power Structures: real power in the organisation may be exercised by a few ‘key’ senior executives, a group of allied executives with similar backgrounds, or a department or discipline, such as finance or marketing. These people have greater influence on decisions concerning the strategic directions for the business and operations.

Control Systems: the internal systems and processes. How people (groups and individuals) are measured, recognised and rewarded. The degree of control or influence provided by major customers over the organisation’s supply chains. How dependent is the supplier on potentially scarce inputs and any resources supplied by outsourced businesses that could be located internationally. Actual payment periods from suppliers’ invoices.

Convert data and information into intelligence

The analysis of a current or prospective tier 1 supplier has been a collective effort by the Procurement team, with inputs from other departments and maybe assistance from consultants). The task is to convert the data and information gathered into an ‘intelligence’ summary report.

The intention is that the report report will gain support from senior management for the actions stated in the Conclusion. It must therefore be only a few pages in length and in a digestible format that can be quickly read and understood. The contents should mainly refer to dynamic information that is subject to change; the more static information e.g.. locations and their capabilities should not be included, but maybe referenced.

Use a landscape format, for both on-line and printed documents. Related information has a clearer layout in presentation

- Identify and use the key issues and essential elements in the data and information

- Summarise the supporting analysis

- Use a bullet-point format with limited explanation, but reference the original document

- Use graphs and charts, but limit the use of tables

- Provide a recommended course of action with timeline, resources required and estimated cost

If a supplier is aware that an analysis of their organisation is being conducted, it is good policy to provide them with feedback of the good and not so good aspects of the findings. This enhances your organisation’s reputation and even if the supplier is unsuccessful in the sale, they may identify potential suppliers in other sectors.