Risks with commodity services.

Many people work in or are affected by the volatility of markets for commodities and commoditised services. The challenge for Procurement professionals and Logisticians is to understand (and plan for) the state of a supply market at a point in time in the future, recognise the associated risks and attempt to mitigate them.

Supply markets and risks in commodity services were recently illustrated by the financial problems of the South Korean owned Hanjin Shipping. This company was ranked number seven in global fleet size, but could not escape the situation of weak demand, excess capacity and subsequent low freight rates.

Within the global supply chains of shippers, there is the maritime supply chain, between shippers and customers which links multiple service providers, including, for example, the unseen but vital: ship’s pilots and tug boats at each port. The links in this chain operate on the basis of trust that each party will be paid for their services. At the first hint of a problem, all that service providers can do is stop the cargo moving – rarely is there a payment contingency plan for when an important link in the chain gets into financial difficulties.

The lack of visibility through supply chains means that when a situation such as Hanjin Shipping hits the headlines, suppliers and retail customers will overreact in securing cargo space, especially if there is an upcoming festive season that will affect sales. The result will be a short term spike in freight rates. As an example, the media stated that the electronics company Samsung needed to replace U$38m of goods held on two Hanjin ships. This would require leasing 16 planes (if available), costing U$9m to transport the replacement 1,500 tonnes of goods.

Demand and supply for logistics services

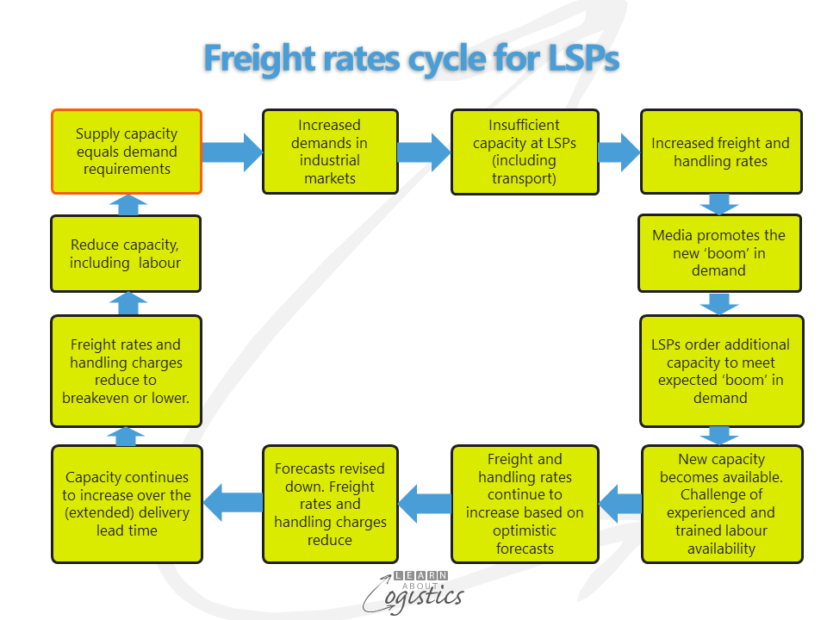

For supply chain professionals, the Hanjin Shipping situation should not have come as a surprise – fluctuating freight rates put pressure on service providers and shippers at different times of the pricing cycle. Commodities, both hard and soft (such as iron ore, coal, wheat and sugar) or service commodities such as transport and warehousing (that is, undifferentiated items) have their price set, through demand and supply pressures and typically in open trading markets. As demand and supply factors are rarely in balance, users must be prepared to respond when the gap in these factors becomes too extreme.

Within transport, when demand outpaces supply, freight rates increase; users must then reduce internal costs to absorb the increased buying costs. When the supply of capacity exceeds demand, prices fall. But low freight rates provide risks for users from the ‘known-unknowns’ – you know something will happen to change the supply market, but you do not know what that something will be. Suppliers can rationalise their business, are taken over or go bankrupt.

The current situation with ocean freight is an example. Even with the number of shipping companies reduced through mergers and acquisitions (M&A), maritime research organisations expect the global container fleet to increase capacity at approximately twice the increase in demand through to 2020. This is because the ‘old’ ships of the fleet are being replaced with larger vessels, some up to 18,000teu, so capacity is not reduced.

This action is a competitive response in a downturn – drive down unit costs; putting pressure on smaller companies to leave the industry. In economic terms, each player (shipping company) in the market is acting in their own best interest. This is ‘game theory’, which states that ‘he who co-operates’ (reduces supply in the hope that prices/freight rates will rise) will always lose ‘against others who defect’ (increase production/capacity to compensate for lower prices). The lowest cost producers (shipping companies) will then have all the power in the market – they will increase their capacity even if that means sustained low freight rates and decreasing margins. This is because they will take market share off their higher cost and lower profit competitors, who must reduce uneconomic capacity, or be forced out of business.

Analyse for longer term risks

The capital investments in new vessels were committed by major shipping companies during the previous period of high freight rates. Even though the new vessels are now a borderline or loss making economic proposition, the shipping companies are so far through the building phase that it is financially easier to continue than stop. However, the effects of these investments (which looked good at the time of order) will be a drag on industry profitability for years into the future.

Based on this scenario, Logisticians should analyse their longer term risks. In the future (after 2020?), increases in demand for shipping capacity should eventually meet the available supply. With fewer competitors and a more balanced demand/supply situation, freight rates will eventually increase. Rising freight rates and changes to exchange rates will affect user’s costs, which could influence supply chain and location decisions. Also, the fewer and larger shipping companies will be in a stronger position to dictate routes and schedules, which could be to the detriment of shippers, their customers and countries.

The scenario discussed also applies to air freight, road and rail transport and warehousing – any logistics service that is undifferentiated – a box is a box and a ship is a ship. A role for management in logistics service providers (LSP) to differentiate their service offerings and not be dependent on market prices. Too often, LSPs offer the same or similar service to all customers, regardless of need and do not identify opportunities to charge a premium for value-added services; instead, cutting prices is seen as the only possible competitive action.

For Logisticians and Procurement professionals at shippers and their customers, risk management and knowing the total cost of ownership (TCO) for items is once again shown as critical aspects of understanding and working with supply chains. This approach minimises surprises and present a more professional approach to senior management.