The heart of a business

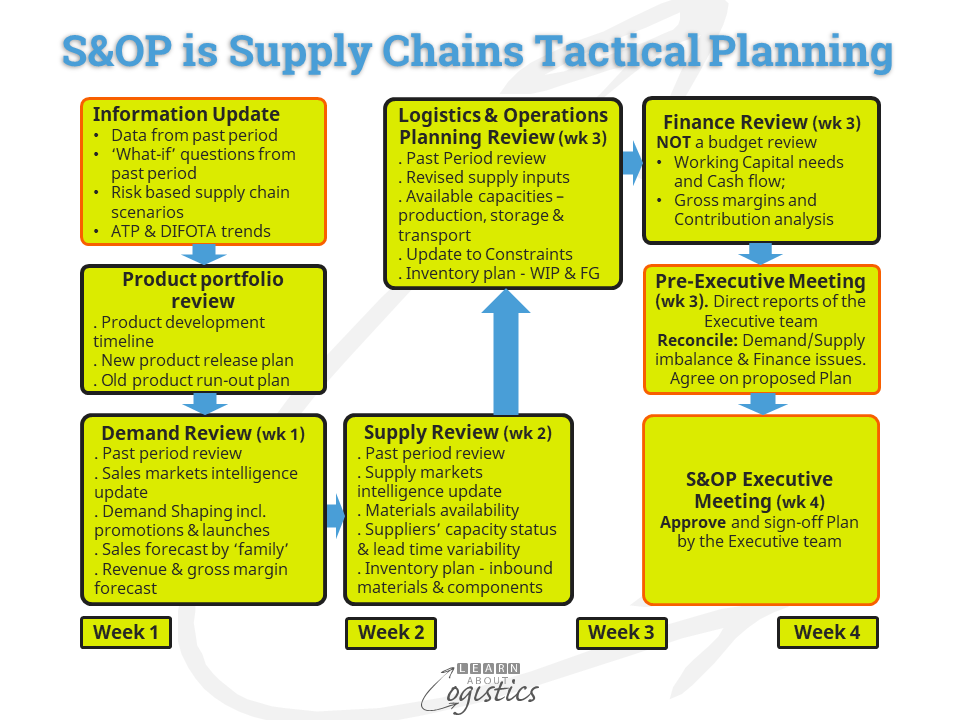

Planning as a collaborative process is the heart of a business. The engine to make Planning and Scheduling happen is Operations Planning, a function within the Supply Chains group (Procurement, Operations Planning and Logistics). The Planning process is Sales and Operations Planning (S&OP).

S&OP can be implemented in any organisation that requires a structured process for balancing ‘demand driven’ sales with ‘supply supported’ resources (suppliers, items, people, equipment).

The previous blogpost emphasised that Planning at the Tactical level is done using data in aggregate. It does not require a complex IT application, large amounts of data and extensive analysis to get the process going. The analysis is undertaken outside of the S&OP process, as shown in the previous blogpost diagram. But it is not meant for all situations. S&OP is not:

- The strategic business plan

- A budget review: S&OP is based on the current inputs concerning demand and supply. A budget is an annual positioning exercise. S&OP is not a finance department budget routine, but a tactical level planning process that must not be constrained by budgets. However, the output from S&OP can be an input to budget updates

- A weekly or bi-weekly Operations meeting. This is the role of the Sales and Operations Execution (S&OE) process, discussed in the previous blogpost

S&OP is a collaborative and inclusive planning process The functions involved in the process are:

- ‘Sales’: groups and departments on the demand side of an enterprise – sales, marketing, customer service, product development and demand planning

- ‘Operations’: the functions that work to supply products and services for sale, including: Procurement, Operations Planning and Logistics (the Supply Chains group); production/operations and technical/engineering

- Finance: evaluates the proposed plans to consider their effect on corporate finances.

- HR/Personnel and

- IT

Structure of S&OP

Any process that has a structure can be accused of being rigid in design and not responsive to evolving economic and business situations. However, S&OP is not a rigid design, being a review process, the results of which become the draft plan that is input to the S&OP Executive meeting. The process shown in the diagram is therefore a guide, which can be modified to suit the requirements of an individual business.

The main features to consider in the design of your organisation’s S&OP are:

Finished products for sale (these are stock keeping unit or SKUs)

- Product lines and groups are aggregated into product ‘families’

- The number of ‘families’ can vary between 5 and 15, depending on the type of business. The typical range is between 6 and 12 ‘families’

- Output from Operations governs what a business can sell. Therefore, S&OP ‘families’ are based on the constraints, capacity and capabilities of resources within ‘Operations’

- Product ‘families’ within a business can also reflect the brands or models that are supplied to major customers, such as ‘private label’ products for supermarket chains and items supplied to individual automotive assemblers

- Within the ERP system of the business, a facility is required for the critical materials ‘quantity per’ in each SKU Bill of Materials (BOM), to ‘roll-up’ into their S&OP ‘family’

Standard unit of measure: The S&OP reviews for both ‘Sales’ and ‘Operations’ are undertaken by product ‘family’, using a standard unit of measure in the data that provides a consistent base for communication across all functions and entities. The standard could be: equivalent shipper (carton size shipped to customers); tonnes; litres; pallets; direct hours etc.

Data: Use aggregated data throughout the process. This assists the Executive team to:

- discuss and agree on the output capabilities of the organisation (based on known constraints);

- assess the value of new product releases and market expansion and

- recognise the potential risks, for customer service, operations output and finances

Tactical Planning horizon

- The S&OP process develops plans over the Tactical horizon for acquiring new assets, which could be up to 18 or 24 periods. However, the ‘freeze’ period, which consists of the current and next period (at least) and discussed in the previous blogpost, is not considered in S&OP

- The S&OP process cycle is typically monthly. However, to obtain consistency and ease of comparisons, it is better to use 13 x 4 week periods per year

Sales forecasts and inventory

- For 24 periods of sales forecasts, a pattern for each product family could be:

- period (or month) intervals between periods 3 and 6;

- quarterly between periods 7 and 12 and

- half yearly for year 2

- Sales forecasts should be a ‘weighted forecast’. That is, provide the probability for both optimistic and pessimistic forecasts by product group within each ‘family’. Optimistic forecasts allow for the forward purchase and storage of critical materials. The pessimistic forecasts allows for firm orders of non-critical materials, with the requirement for suppliers to increase supply to meet the optimistic forecast.

- Inventory is described by form and function for each ‘family’ at Nodes in the supply network

Review meetings

- For each review meeting, the target time is less than one hour. To ensure this happens, meetings are held late in the afternoon when attendees are anxious to go home. It will usually take the first three Executive meetings for attendees to understand the one-hour rule. The chair (P&L responsible manager) must ensure a ‘balance’ between the inputs to the process by the ‘Sales’ and ‘Operations’ groups and other functions, as they learn what collaboration requires.

- There are two parts for each review and executive meeting. The first (and shortest) part is a review of recent performance and lessons learnt (called the past period review). The second (and much longer) part of the meeting considers the intended plans and actions to meet expected customer demands, against the most likely available capacities and capabilities.

- The S&OP Executive meeting is for the senior management team and attendance is part of each executive’s performance measure. If the P&L responsible manager is unable to chair the meeting, it is rescheduled. No substitutes are allowed, as it can become a habit and the S&OP implementation will fail through a lack of commitment. The objective is for the executive team to approve an achievable S&OP; taking collective responsibility to rectify major variances against the plan. This reduces the ‘finger pointing’ and recriminations that occur when supply chain activities are planned in silos.

- Because S&OP is the Tactical level Operations Planning process, the Supply Chains group has responsibility for guiding the process. Specifically, the Master (or senior) Planner of the SBU is responsible for facilitating the progress and completion of each step in the S&OP process.

In multi-nation businesses, the SBUs and divisions must have a common approach to S&OP. This includes common definitions that cover demand, supply and planning elements. Also, the S&OP responsibilities within the enterprise must be identified – global planning authority; region responsibility; matrix organisations (local operations and region/global services) etc.

The only factor missing is the willingness to make it happen. LAL has heard many excuses for not implementing S&OP, but most of the CEOs of businesses that did implement found the process helpful as a means to gain collaboration across the business.