Flow of a supply chain

Visibility through your organisation’s supply chains is an objective that will be difficult to achieve. Even if your organisation considers itself a domestic business, the inputs of purchased items and their suppliers could be global.

Anticipating potential shortages in supply chains can be difficult. A brand manufacturer or assembler may be closely linked with their tier 1 suppliers, but less likely the suppliers’ suppliers; especially for speciality materials used by suppliers at extended tiers in a supply chain. A supposed ‘non-critical’ purchased item can stop an assembly line if it is not available

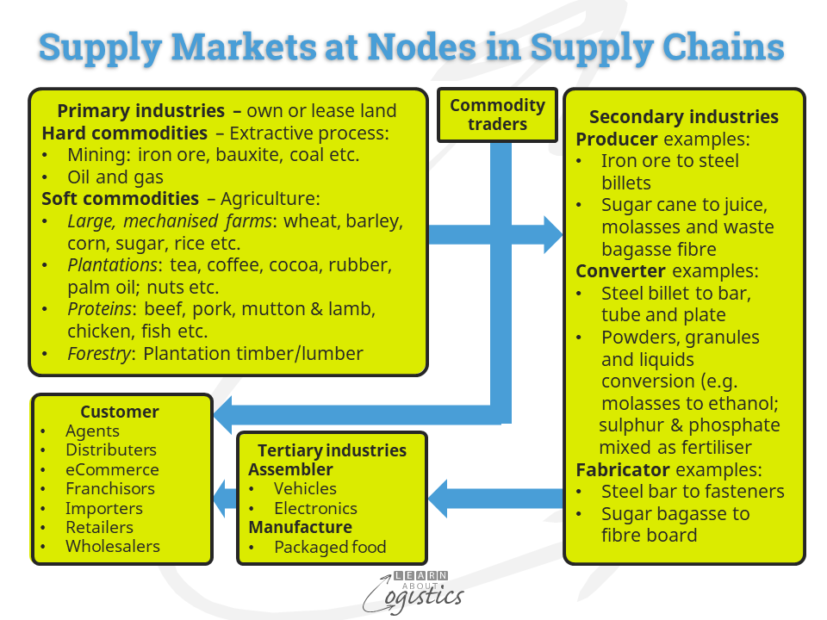

The diagram illustrates the flow of a supply chain, comprising three stages of industries – primary, secondary and tertiary. All or part of the chain could be produced within ambient, chilled or frozen operations. At each stage, the suppliers will have their ‘channels of distribution’ to service customers – all without the direct knowledge of businesses at the ‘tertiary’ and ‘customer’ stages.

However, as an input to forecast sales, a ‘customer’ stage business should ideally have some understanding of the supply situation. Farms and mines can be located in many countries, with their associated inventory stockpiles, which are often pre-sold to unknown buyers, The future situation with global supply for a commodity is broadly known through information provided through specialised media. Futures markets also provide an indication of availability for the commodity through the quoted ‘futures’ contract price.

Gathering information about supply chains

But, to anticipate potential shortages of input items through the supply chains is more difficult. That is, gathering information about suppliers at tier 2 or 3, with whom a ‘customer’ or ‘tertiary’ level company does not have a contractual relationship. These suppliers are often not known, because tier 1 suppliers (‘fabricators’) are reluctant to divulge this information.

Tier 2 and 3 suppliers can have multiple, global locations and identifying the items manufactured at each location will take superior detective skills. Potential disruptions in the supply of materials other than the main commodity type can also be challenging. For example, the supplier of a speciality lubricant to a metals fabricator.

Then there is the transport mode(s) between each stage of a supply chain, the route capacity available and potential congestion points. It will take considerable investigation to identify the transport mode used when it can be an either/or situation. If the assumption is that an intermediate item is transported from China to Europe by ship, but the supplier switches mode to rail, the potential risks will differ under each scenario.

This illustrates that the term ‘end to end’ supply chains is questionable. The term should not be used when only referring to your ‘core’ supply chains. ‘End to End’ should be applied to a total supply chain from end user back through the brand company to its suppliers at multiple tiers and finally to the commodity suppliers at farms and mines. In any case, define what the ‘ends’ means in your business.

Over the past forty years, changes in taxation rules, investor expectations, communications capability and transport infrastructure has allowed some business in developed countries to:

- Outsource operational functions and contract-out individual activities

- Source globally for materials, parts, components (intermediate products) and finished products

- Locate production offshore in low-cost countries (LCC) and

- Increase the number of stock-keeping units (SKU), to provide product differentiation across smaller market segments

These changes in business practices have influenced changes to supply chains across four dimensions:

- Increase in the number of direct (tier 1) suppliers in the supply base

- increase in the number of tiers (levels) of suppliers, due to tiers 1 and 2 suppliers also outsourcing functions

- Spread in supply chain ‘nodes’ (global locations for receipts and deliveries of customers and suppliers)

- increased lead times for items, requiring higher safety inventory and costs

The likelihood of disruptions to the effective and efficient supply and distribution of items is increased as the eight factors interact and amplify each other. The resulting complexity and potential dependency has increased Uncertainty in organisation’s supply chains. Also is the challenge of managing an increased number of SKUs within one inventory system delivering through multiple distribution channels (called ‘omnichannel’) for different categories of products. This is a significant Risk management issue, for which supply chain professionals will be held responsible.

Channels of Distribution

Although the diagram finishes at the customer stage, there is the final step of having items available for sale to consumers. A Supply Chain ensures Availability of items; Channels of Distribution satisfy the Demand Chain. Channels from the brand company at the ‘tertiary’ industries stage to the consumer, can be a mix of:

Direct channels owned or controlled by a brand company (a shipper), for sales, storage and delivery of items

Indirect channels – reselling, storage and delivery of intermediate and manufactured/assembled items. Of the list in the diagram under ‘customer’, the channels of eCommerce, franchisor and retail have the infrastructure to directly connect with consumers. Generally, the role of the other four customers is to use their channels to supply products for the first three. In addition, ‘Trade supply’ channel examples are:

- Food service for hospitality sector

- Cut length supply service (steel, aluminium, timber)

- Electrical supplies

- Agricultural industry inputs e.g. fertilisers

Deliveries to consumers can also be made via the channels of: the route trade (vans or even motorcycles loaded with popular product lines to sell), ‘pop-up’ vans at venues, markets stalls, vending machines and party sales. events.

Servicing the channels can require multiple warehouses and distribution centres (DCs) that can be owned and operated by different businesses, using different IT systems and with different transport modes and operators (links) between the nodes. Commencing at the factory warehouse (possibly in multiple locations), products can be delivered to a geographic region warehouse, then to a warehouse in a country; then to city warehouses or DCs and finally local DCs (which might be attached to a retail shop). Direct delivery to consumers can happen from any of these facilities.

Delivery routes structures and transport modes and operators to service retail locations are dependent on the geographical area being serviced: Inner city; Inner suburbs (5-10km ring of a city); Outer suburbs of a city; Region outside a city (2 hours driving distance); Rural and remote.

Channel of distribution challenges for Logisticians will differ by geographic region and country. Influences on decisions will be at least: Culture and organisation structure of the business; Location density for warehouse activities, Transport infrastructure; Communications technology and Payment systems in the country. Importantly, copying what other organisations are doing in terms of: customer and supplier relationships, people management, technologies and capital investment, may not provide the ‘best’ solutions for your business.