Attributes of a LSP.

LSPs review their business strategies on a periodic basis, to identify how they may gain a larger share of clients’ logistics services spend. The previous blog contained a table that identified seventeen different business types operating within the Logistics Services industry. These illustrate the many options and potential opportunities available for LSPs to grow their business.

The Logistics Services industry is fragmented. The Materials Businesses Services and Professional Services segments are dominated by small and medium size enterprises (SME). In the Goods Movement Services segment there are a few large businesses in the transport, 3PL, freight forwarding and parcel express sectors and many small, owner-operator transport and warehousing firms. These businesses can be proficient in a service category, to their own account or as sub-contractors to larger 3PLs. The owners are likely to be opportunistic in obtaining new business and be price takers.

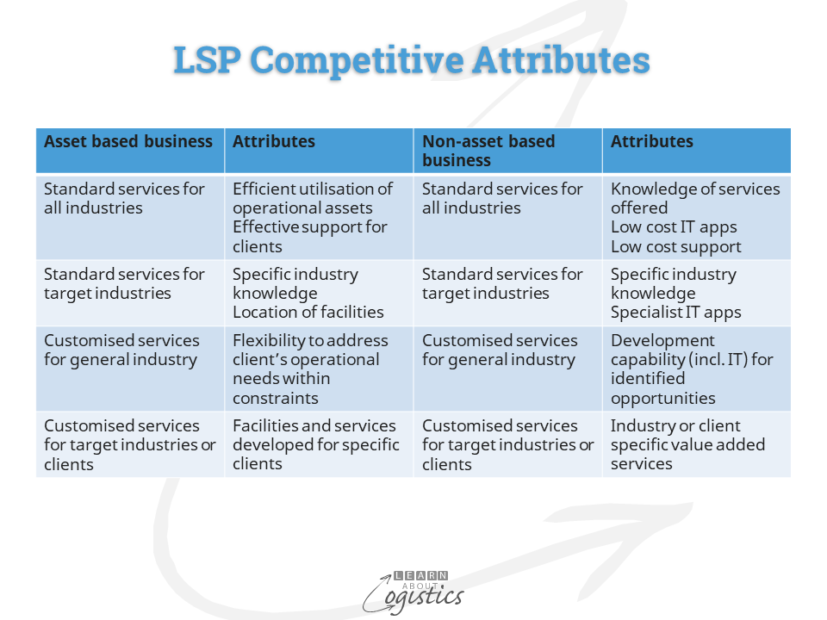

However, for medium and large logistics services businesses a strategy review is required, based on some broad attributes of the business:

- Asset based or non-asset based organisation

- Asset based organisations own or lease facilities to service their clients needs for moving and storing items. These businesses are typically found within the Goods Movement Services segment of LSPs, with third party logistics providers (3PLs) being the most conspicuous

- Non-asset based LSPs are typically found within the Materials Businesses Services and Professional Services segments. They sell expertise in a particular sector or professional discipline and may include specialist IT applications in their offerings

- The geographic area in which the business operates. This can range from a single town or rural area through to a global reach

- Focus for the Logistics Services offered:

- Standard services for all industries

- Standard services for target industries

- Customised services for all industries

- Customised services for target industries or clients

For each focus, the table identifies just some of the attributes required. However, the scope of each attribute may be constrained by, for example: the link in a supply chain where the 3PL operates, legal limitations on activities, location of clients and their customers and the storage and ease of handling requirements for specific materials and goods.

Shippers expectation of an LSP operating in the segment is most likely the daily operational effectiveness and efficiency against the contract, which too often is based mainly on price. Less clear are the expectations by client for a more multi-dimensional approach to the contract, such as the capability to effectively manage the client’s variables in demand and supply, including man-made and natural emergencies. Additional examples of challenges to growth for LSPs in the Goods Movement Services segment are:

- Achieving what was originally promised to win the contract

- Improving the satisfaction level for provided IT services

- Demonstrating ongoing projects that reduce costs and/or improve service

- Addressing the threat that elements of the process, or the whole process could be overtaken by a different technology or a disrupter startup

- The closer a services business is to the ultimate consumer, the more likely this could occur

- Selling the capability to be entrusted with more responsibility

Growing a LSP business

LSPs in the Goods Movement Services segment generally have a low earnings-to-sales ratio on a pre-tax basis. Size of the business and low unit costs are features of ‘successful’ businesses in any commodity (i.e. undifferentiated) market; LSPs providing standard services need to look at expanding their client base and reducing unit costs. Examples of strategies to reduce unit costs are:

- Use larger transport units – ships, trucks, trains

- Centralise distribution (where feasible) within countries and regions, to provide a ‘hub and spoke’ network

- Improve asset utilisation

- Align with property developers and complementary LSPs to build a geographically concentrated set of logistics services. This enables more effective freight movements to maximise the utilisation of assets i.e. freight activity centre, logistics village or other entity title

- Share assets with other LSPs to improve the utilisation of assets

- To address changing client requirements, negotiate flexible leases for facilities that can be easily modified

- Mergers and acquisition (M&A) activities, which could include:

- Vertical integration up and down a supply chain. It may gain attention from competition regulators

- LSPs, contract manufacturers and IT services combine to handle price driven products that are low end and generic but ‘complex’, such as automotive parts and ‘over the counter’ pharmaceuticals

In addition. examples of options to expand the client base in this segment are to provide:

- Additional logistics services from the Materials Businesses Services and Professional services segments, to offer a more complete service for clients

- Logistics services targeted at specific industry sectors

- Knowledge and expertise can provide increased profit margins for specialised services

- Depends on the industrial and commercial structures in each country

- Sustainable supply chains advice

- Identify the level of risk that a client will accept in its supply chains

- Identify changes in strategy and culture required to reduce vulnerability in the client’s supply chains

- Facilitate the management of clients’ inventory e.g.

- Track and trace capability for improved control of inventory

- Link with a financial firm to provide inventory financing for shippers

- IT expertise:

- Provide IT systems and applications in an area of Logistics specialisation

- Negotiate with clients’ Supply Networks to improve network visibility

- Invest in and provide expertise in new technologies for Logistics

- IT supported capabilities for:

- International trade compliance and contracts

- Supply Chain Analytics, including analysis of total landed costs for client orders

- Input to clients’ S&OP process

- Improving operational processes between client, LSP and customers

- Network interface capability

The uptake of services provided by LSPs has different levels of maturity by country, depending on the acceptance of outsiders being involved in a business. In developed countries, the market share for logistics services is generally high. Therefore, to grow a LSP business will likely require a review of the range of services offered and manner of delivery, for which this discussion provides some inputs.