Summarising likely changes

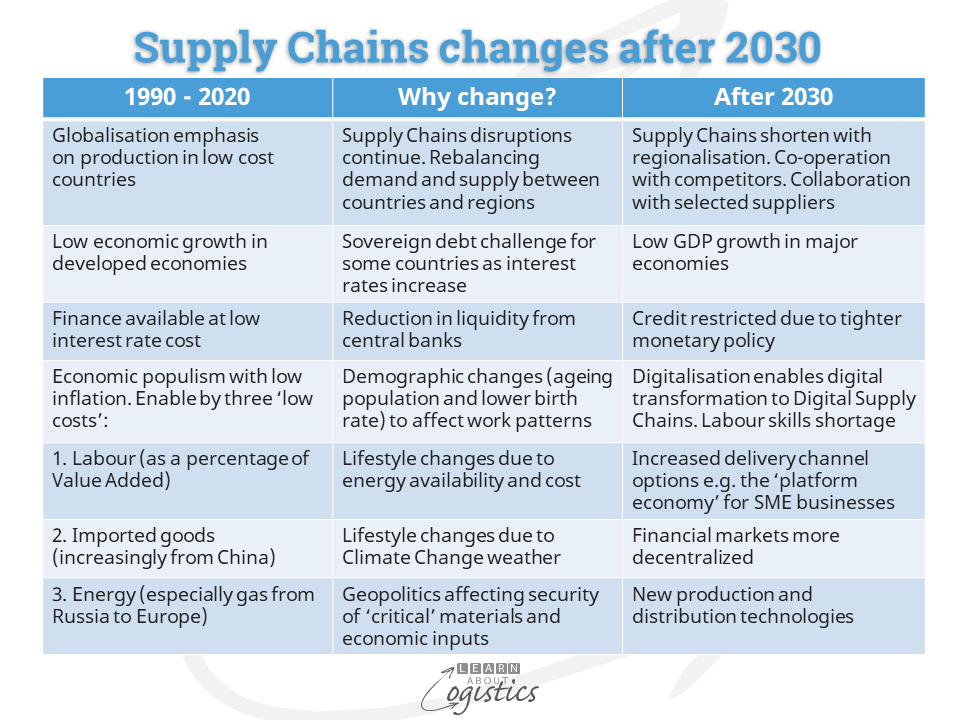

In the near future, many country’s economies will be different and not just a version of that experienced for the past thirty years. The reasons are not all economic but are likely to drive uncertainty as disruptions and changes become more frequent, with unknown outcomes.

The Learn About Logistics blogposts through November have discussed aspects of changes that could affect your organisation’s supply chains. These are summarised in the table below.

A recent report

A Reuters Events report, (available for subscribers) titled A generational shift in sourcing strategy. Although written from a mainly European perspective, the questions raised are relevant to businesses in all regions.

The main findings in the report are that supply chains will rebalance and deleverage from concentrated areas of production. They will move towards locations that are closer to end markets and to a wider range of low-cost countries. This is to provide the flexibility and resilience required for reduced delays, transport costs and shortages of materials and intermediate products that are traded over long distances.

Companies will need to look more closely at the total landed costs or total cost of ownership (TCO) and the impact cost of not meeting market demand. While it remains unclear how pervasive the move to on-shoring and near-shoring will be, increased geopolitical uncertainty and changing trade policies are an important determinant that are already impacting supply chain decisions in some business sectors.

Terminology

- Reshoring: The practice of moving organisational productive capacity to the same market as where the final product(s) is utilised or sold.

- Nearshoring: The practice of moving organisational productive capacity near to where the final product(s) is utilised or sold.

- Near-sourcing: The practice of sourcing items or productive capacity from a supplier near to where the final product(s) is utilised or sold.

The top five reasons for changing sourcing location are noted as:

- Shorten supply chains to increase flexibility

- Limit reliance on single sources for materials

- Limit risk across supply chains operations

- Shorten supply chains to reduce transit time

- Increase control over supply chains operations

The emphasis is not to identify where production costs are lowest but instead prioritise shorter supply chains, flexibility and risk mitigation to improve reliability, proximity, speed, visibility and sustainability ahead of cost. This is to provide reliability of delivery, proximity to end markets and labour skills mix that assist productivity.

The report provides a comment concerning risk in supply chains: “So, the leading question today is how to measure and objectivise the risks associated with geopolitics. That’s the key underlying question; all the rest is relatively easy. You have quantitative metrics: You have inflation; you have unemployment; you have education levels; you have taxation rates; you have governance structures. All of that you can quantify to a certain degree. What you cannot quantify that easily is the geopolitical risk. This is where I’m focusing.” Karel Stransky, Head of Corporate Industrial Advisory, Occupier Services EMEA, Colliers

Identifying and securing alternative suppliers will be gradual

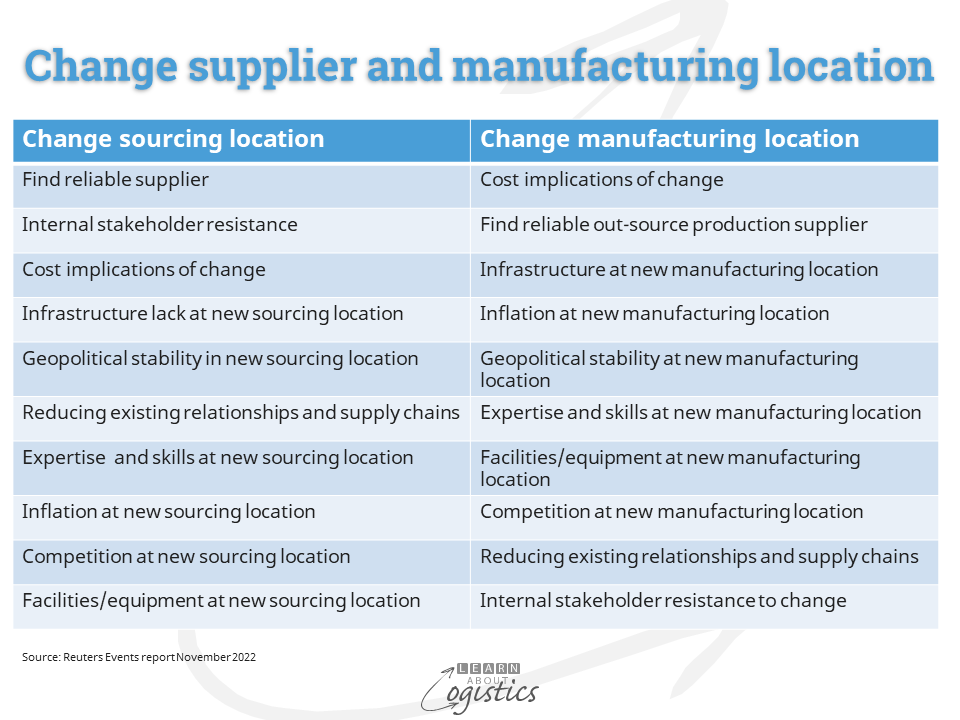

The table below lists the main barriers to changing suppliers and production locations. It indicates levels of importance for the designated factors and therefore the risks that must be identified and mitigated.

Positioning of factors in the list indicates why moving manufacturing locations is more challenging than a change to sources of supply. Manufacturing is riskier, more expensive and time consuming and therefore fewer businesses will consider this change.

However, the decision is industry dependent, with Consumer-Packaged Goods (CPG) and Fast-Moving Consumer Goods (FMCG) able to bring new capacity online relatively quickly, verses (for example) pharmaceutical and electronics, which require a higher degree of technical expertise and more costly equipment.

Locations for suppliers and out-sourced manufacturing

The report identified an approach of ‘distance rings from the sourcing company’ to select locations for sourcing intermediate items and products, out-sourced production and Foreign Direct Investment (FDI). Use the United Nations Industrial Development Organization’s Competitive Industrial Performance Index (CIP) as a proxy for competitive national manufacturing capability.

For production locations, companies are more likely to identify where a high proportion of workers in the manufacturing sector already exists. The top 10 countries by this measure have about 20 percent of their workforce employed in manufacturing roles.

Ring 1: High-income, developed economies. A requirement for infrastructure-enabled locations with the needed labour skills mix, as production processes become more automated and products more complex. The productive capacity of these countries will expand in complex, high-value, high-tech, time-sensitive and strategically important production processes. Also, final assembly and test.

Ring 2: Close to North America and western Europe (Japan has established trade links in nearby Asai). Locations have favourable time to market, skilled workforce, transport costs and trade bloc membership. These factors, combined with lower labour costs than high-income countries, will increase growth in sectors where competitive advantages exist:

- For North America market: Mexico (a part of USMCA trade agreement) and some countries in Central and South America

- For western Europe market: countries in Eastern Europe

Ring 3: Proximity to end markets and infrastructure that supports the production of intermediate goods and consumer items.

- For North America market: some countries in Central and South America.

- For Europe market: some countries with proximity to land corridors into Europe and some countries in North Africa

Ring 4: While low-cost production in Asia will remain a factor, companies must be less geographically limited to single countries or regional clusters and more able to source from a variety of locations, wherever possible. For companies with a presence in China, consider a ‘China+1 or 2’ location strategy at established and growing manufacturing locations in Asia for competitive products.

Larger companies (>U$1b annual sales) are more likely to consider their approach is driven by risk reduction, through increased flexibility and improved access to components and intermediate goods. Smaller companies (<U$250m annual sales) are more likely to be adapting their sourcing strategy due to economic pressures and input costs.

Supply Chains Research for suppliers and locations

Your organisation’s Supply Chains Network Design map is the base document. When researching for alternative suppliers and manufacturing locations, the data in the Design map can be enhanced with current intelligence at the following sites:

Bloomberg Professional Services: Global Supply Chain Data

FactSet Supply Chain Relationships

Interos Supply Chains Risk Management

Changes to supply chains will not happen overnight but Learn About Logistics considers that by 2030 changes will have commenced. Supply Chain professionals therefore have a responsibility to review their organisation’s Supply Chains Network Design map and identify changes to be implemented over the next seven years.