Welcome to the 2020s

As yet, this is a decade without a name, but ‘the decade of living dangerously’ could be an apt title, especially for supply chain professionals.

This is because four factors are likely to influence supply chain investment proposals and decisions: climate change; geopolitics; international trade flows and supply chain technologies. They interrelate and therefore provide complex challenges, for which there are unlikely to be simple solutions.

Supply chain investment challenges

In the 1980’s a group of scientist at the Santa Fe Institute in New Mexico, developed the theory of complex systems. From a business perspective, the fundamental premise is that commercial trading is undertaken by networks of independent organisations. However, a network’s operations cannot be improved by attempting to understand the parts, for two reasons:

- ‘emergence’ – outcomes within each entity, resulting from the operations of complex systems. These cannot be predicted with certainty and

- ‘adaptability’ of a network, as independent entities respond to changing situations. This cannot be predicted, due to the lack of a central control mechanism

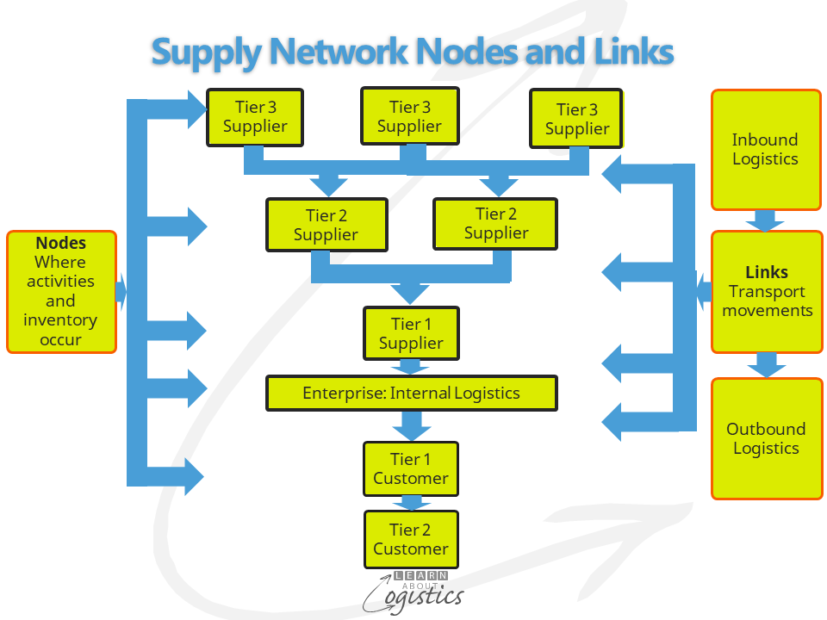

A Supply Network is a Complex Adaptable System. As illustrated below, your organisation’s supply network consists of all the supply chains – inbound, internal and outbound and the relevant supply chains of tier 1 customers and tier 1 suppliers and their customers and suppliers.

Inherent in the complexity of supply chain problems are two factors:

- options available could contain many risks, not all of which are known and

- consequences of decisions made. Not all of which are known and some could be unintended

The researchers at Santa Fe Institute considered that organisations can only respond to complexity by empowering knowledgeable and capable people working as problem solvers. ‘Intelligent’ systems providing simple solutions will not suffice. To paraphrase the journalist and scholar H.L Mencken: “there is always a simple solution to every complex problem that is neat, plausible and wrong”.

As problems become more complex, the added challenge for supply chain professionals is the likelihood of insufficient data for a comprehensive risk analysis and insufficient time to fully evaluate the options.

Challenges when evaluating future risks in supply chains

Climate change will challenge supply chain decisions in this decade. Weather patterns are starting to visibly exhibit exponential increases in intensity, of which the recent bushfires in Australia provide an illustration. Some commentators are calling this a ‘gradually, then suddenly’ world, whereby natural weather conditions could rapidly worsen.

To maintain an increase in global temperatures below 1.5°C requires that carbon emissions cease within eight to ten years; this is unlikely to happen. Therefore, analysis of future investments in supply chains should not be based on past experiences.

Geopolitics is a field of study that has increasing importance for supply chain professionals who work with international customer and supplier markets. According to the firm Geopolitical Futures, three factors shape how a country or block of countries positions itself over the long term, the:

- constraints of place (geographic location)

- degree to which the various internal systems interact to create power in all its dimensions

- power, fears and desires of surrounding communities

GF explains how, with the 24 hour news cycle, our plans and strategies can be affected by individual events, which are “…startling to an observer only if they fail to see the broad process underway, without which the important is overwhelmed by a mere set of current events that flow from the important but are contained in a predictable emergence”.

An understanding is therefore required of the likely longer term evolution of each customer and supplier country’s relationship with the world. This includes the constraints and incentives that customers and suppliers are likely to work within.

International trade flows have grown (within the ‘globalisation’ mantra) over the past forty years assisted by:

- Suppliers located anywhere

- Final assembly and test facilities located in low-cost countries

- Outsourced supply chain functions

- Growth in sea and air ports and distribution locations

- Reduced transport unit costs through the use of large transport units

- Favourable tax regimes for dispersed activities of multi-national corporations (MNCs)

One result has been more complexity in the planning and operations of supply chains.

However, the financial crisis of 2008 commenced a ‘pull back’ in enthusiasm for globalisation. Appeals to nationalism within counties have subsequently influenced restrictions to international trade by increasing tariffs, introducing non-tariff restrictions and minimising the role of the WTO.

Concurrently, the desire for reduced delivery times and hopes for improved visibility through supply chains could influence further development of regional supply chains. But these are unlikely to be less complex.

Technology selection and implementation will continue to challenge supply chain professionals. Those who develop and sell the technologies will try to convince prospective customers that now is the time to invest, or be left behind. At the same time it can be difficult for users to construct a compelling justification with an acceptable return on investment (ROI). But, be assured that if a technology has a future, it will be available next year and the year after and maybe in an upgraded form!

Investment Decisions and Outcomes

A criteria used by financiers for investment decisions is the 30 year mortgage. So, should investment options identified today be balanced against the risks anticipated out to 2050? The challenge is that our understanding of physical and trading conditions into the future will be a ‘guesstimate’ at best and the response of investors and capital markets even less so.

“Because capital markets pull future risk forward, we will see changes in capital allocation more quickly than we see changes in the climate. In the near future – and sooner than most anticipate, there will be a significant reallocation of capital” Larry Fink, CEO of BlackRock, the world’s largest asset management firm.

Fredkin’s paradox observes that “we worry, hoping to see into the future. In the worst case we choose none of the potentially good options, but a bad one”. Therefore, “…to the extent that that we are unable to know how things will turn out, overthinking is futile…It will have mattered in hindsight, which is too late”.

When making investment decisions and given the two observations, an approach is to undertake the most effective (but not exhaustive) risk analysis and then make the ‘best’ decision based on the information available. This recognises that when a decision turns out to have bad consequences, you should quickly retrieve Plan B from your back pocket!

Learn About Logistics wishes you all the best for 2020. To assist in addressing your challenges, the points noted above (and others) will be discussed throughout the year.