A direction for Procurement

As the COVID 19 pandemic progresses, so commentators discuss the ‘new normal’ and effects on supply chains. One of the most common observations is to reduce dependency on suppliers from China and to move away from sole or single source supplier arrangements.

But, is this good strategic sourcing or just a response to immediate events? Strategic Sourcing is ‘the interactions with supply markets to understand the current and potential situation and how the organisation may influence a supply market’ (adapted from Steele & Court 1996).

In the late 1980’s, a similar surge of comments about the effectiveness of Procurement led to the approach of ‘partnership sourcing’ to overcome perceived inefficiencies in Procurement. This approach favoured ‘sole source’ (one source supplier at one location) and ‘single source’ (one source supplier at multiple locations).

Partnership sourcing also generated the common use of the terms ‘partner’ and ‘partnership’ in business and government – even in 2020!. Although the word ‘partnership’ means the ‘sharing of risk and reward’, this has generally been ignored and ‘partnership’ is now used loosely to describe a range of business relationships.

Even though commentators predict an increase of ‘on-shoring’ and ‘near-shoring’ for developed countries, supply chains for industries will continue, although maybe with modifications e.g. North Asia for electronics. So, complexity through supply chains, including global sourcing, is unlikely to reduce.

Instead of rushing to follow the advise of commentators to change business relationships with suppliers, it is better for your organisation to provide the time and resources for Procurement to undertake an evaluation of current and potential suppliers.

Spend Analysis

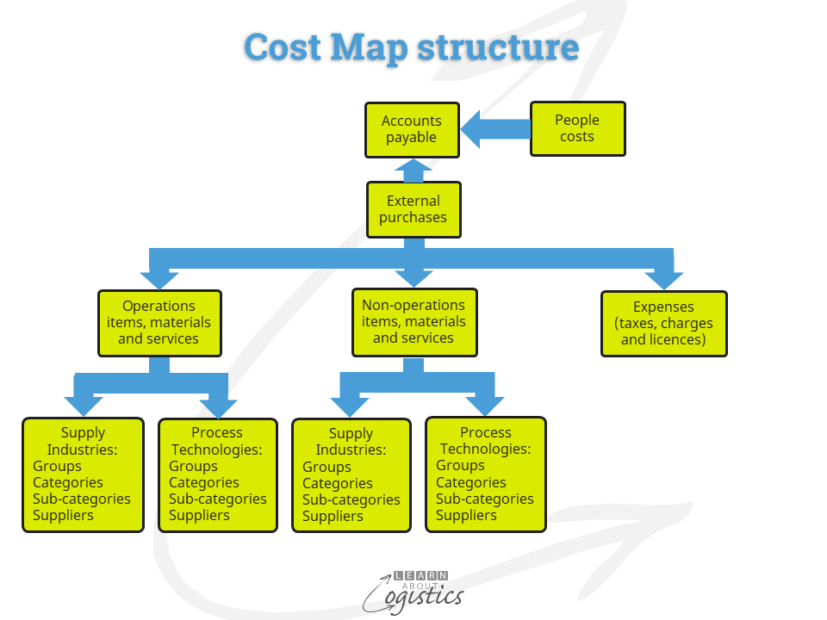

The evaluation process commences with Category Segmentation. The numbers are obtained from the Cost Map in corporate accounts, but unfortunately, standard accounting applications are not structured in a format that is suitable for Procurement. So, to get the information requires you to be nice with the people in Finance and IT.

The objective of Category Segmentation is to provide a logical structure for understanding the purchases of the organisation. Through this exercise, the range of similar items purchased within categories and the range of suppliers are identified. For example, an electronics company purchased 47 sizes of fasteners and a food business purchased 13 types of pepper! An outcome required is to identify the necessity of buying some items and the potential of consolidating current purchases and suppliers into larger potential contracts.

The purchased items are initially grouped as either ‘supply industries’ or ‘process technology’. The categories of spend will vary to suit the needs of each organisation; however, examples within each group can be:

Supply industries groups: Metals type; Ingredients type; Packaging type etc. For example:

- A supply industries group is named ‘Ingredients type’

- A Category within this group is named ‘Sweeteners’

- One of the sub-categories is named ‘Glucose’

- Supplier(s) of glucose are:

Process technology groups: IT and telecoms; Logistics services; Travel and entertainment; Facilities etc.

- A process technology group is named ‘Facilities’

- A Category within this group is named ‘Industrial supplies’

- One of the sub-categories is named ‘Safety glasses’

- Supplier(s) of safety glasses are:

The Pareto principle (or 80/20 rule) states that few items or factors dominate results. When applied to suppliers, a general picture for an organisation is:

- A category suppliers: 15-20% of suppliers; provide 70-80% of purchases

- B category suppliers: 20-40% of suppliers; provide 10-15% of purchases

- C category suppliers: 40-65% of suppliers; provide 10-15% of purchases

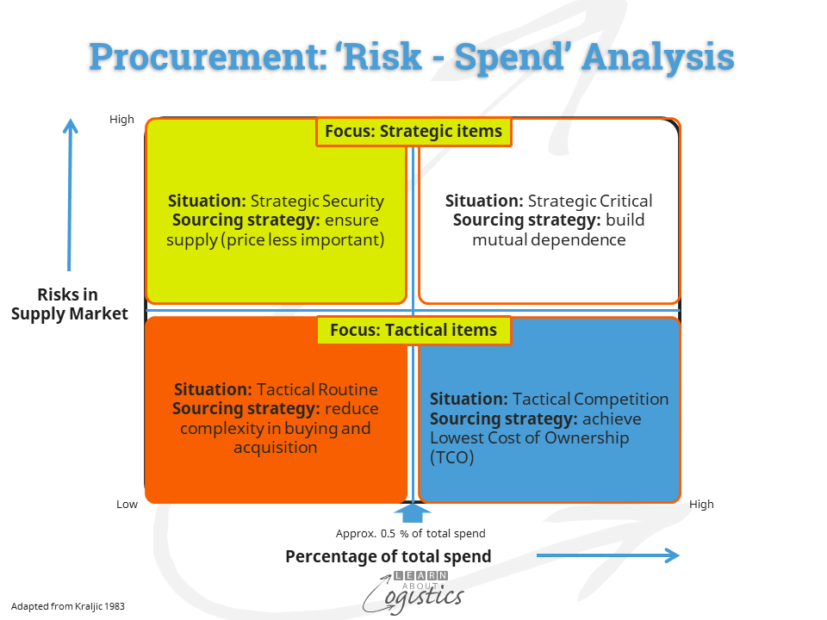

This indicates that relationships with suppliers must differ, but the relationship should not differ on the basis of annual purchases. Instead, the spend figure should be balanced by Risk factors. The more risk associated with a supplier, the more strategic is the buy.

Risk – Spend evaluation

A continuing challenge for Procurement professionals are the unknowns when negotiating with external organisations. These can be summarised as quantifying the effects of Uncertainty that surround a possible supply contract and the potential value to be gained from spending on that supply contract – that is, the measure of performance.

Uncertainty should really be considered as unstructured opinions. To better understand Uncertainty in supply markets requires Procurement professionals to evaluate, analyse and rank Uncertainties within and surrounding the suppliers. This process changes Uncertainties to structured Risks; ideally generated within a corporate Supply Network Risk Management regime.

In the early 1980s this approach was placed into the Risk – Spend matrix.

Recent articles have discussed the potential risks of not having access to what are called ‘critical items’ in developed countries that, over the years, have outsourced or contracted their purchases to suppliers in global locations.

One of the risk elements not discussed is the location of a supplier’s operations. Even though video conferencing, emails, messaging and telephones exist, the potential for problems to escalate is higher the further a supplier is from the buyer. A rough measure is that the potential for escalation is twice the distance (in total travel hours) from the purchaser’s location within the region. If the supplier’s location is in another region of the world, the potential increases to three time the total travel hours.

This and other risk elements, to be discussed in following blogposts, suggests that the sourcing, purchasing and acquisition of ‘strategic items’ requires an even more focused attention than they might have received prior to the pandemic.