Analysis and intelligent systems.

Analysing the total spend of your organisation on a regular basis appears to be a logical and sensible task. But why do few organisations do it, especially with access to IT applications that enable ‘big data’, pattern recognition and artificial intelligence?

Some of the answer has been made public in Australia over the past few weeks, with publicity about the federal government undertaking an IT based review of payments made to claimants of social security payments. The advent of ‘big data’ and the linking of federal government IT departments has meant that the department handling social security can access data files of claimants and pattern match them for anomalies in claims.

But, of no surprise to many, the ‘intelligence’ within the analysis application has been shown to be limited. For example, a person who was retrenched by Ford, when it closed its Australian manufacturing in 2016 could be listed with social security has having worked for Ford Motor Company but with the Taxation Department, shown to have been employed by Ford Australia. The analysis application recognises two different companies and assumes the person has falsely claimed to have only worked for one company. Based on this reasoning, the computer automatically sends a letter to the person demanding repayment of unemployment pay. This, an other ‘features’ of the analysis is causing much angst in the community.

Sad as the situation is, what has it to do with supply chains? Well, if the government departments had enquired of commercial businesses about how they analyse the organisation’s total spend, including the interrogation of data from multiple divisions and operations, the answer would generally be ‘its too hard’.

Spend Analysis in your organisation

Spend Analysis is the process of understanding the pattern of purchasing spend within an organisation. To achieve this, an organisation must be able to collect all the data concerning transactions with external parties within one system. This system will have two main applications – Procurement (the buying part) and Spend Analysis; in the middle is the Accounting system. The system addresses the Procurement Strategy.

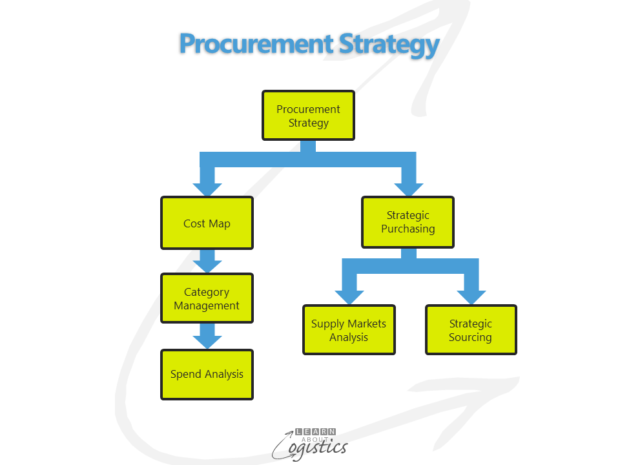

The Procurement Strategy identifies how Procurement will provide a commercial competitive advantage and maximise contribution to corporate profitability. The diagram illustrates the framework – the left side for all purchased items and services and the right for specific items and situations. This shows that the Procurement Strategy must be implemented before there can be effective Strategic Purchasing. An element of the Procurement Strategy is Spend Analysis.

The outcome of Spend Analysis is to identify:

- What has been the organisation’s spend for each Procurement category in the previous period (year, quarter, month)?

- What are the highest spend commodities over successive years?

- Does the spend within a category identify whether the organisation can exert buying leverage in that supply market?

- Which categories show potential for spend reductions?

To do this requires access to the transaction data in the Accounting system that tracks all orders and payments. As would be expected, corporate financial and accounting systems are designed for accountants, not Supply Chain professionals. The general ledger, cost centre and other codes are created to facilitate Accounting processes rather than Procurement.

The requirement of Procurement is therefore for transactions, from order to invoice, in the accounting system to be retrieved, cleansed, consolidated and organised to provide information for the Spend Analysis. To sort the accounting transactions into a meaningful structure for this activity requires implementing Spend Analysis software that is capable of operating across multiple systems (head office and subsidiaries/divisions) to gather the transactions.

After the data is retrieved, it must be cleansed so that information is meaningful for analysis. Examples of instances that are important to resolve for Procurement, but not for Accounting are:

- Suppliers can trade under multiple divisions and businesses, although ultimately owned or controlled by one entity

- A supplier’s name can be entered differently in the buying organisation’s accounts payable files. For example, as noted above, Ford Motor Company and Ford Australia

- There are multiple general ledger and cost centre names

- Categories and standard industry (SIC) codes may be used in one part of the organisation, but not others

- Descriptions of the product or service can vary, depending on the user

Spend Analysis IT application

The data must then be classified to ensure that items are correctly classified and then analysed. To address all these requirements, a Spend Analysis IT application must contain five components:

- Data capture – software to collect and consolidate spend data in purchase order (PO) and accounts payable (A/P) applications located in multiple IT systems, business units and geographies

- Normalisation – to eliminate discrepancies within the downloaded data from multiple sources

- Classification – code items based on a uniform schema to ensure commonality for the same items. Likely to use the United Nations Standard Products and Services Code (UNSPSC)

- Analysis and reporting tools

- Data warehouse tools at the central repository for downloaded data

Spend Analysis will only occur if your organisation’s management decides that a Procurement Strategy will be implemented. To assist in overcoming the challenges of implementing a Procurement Strategy, your organisation requires:

- Procurement professionals employed with a knowledge (and practice) of Procurement Strategy and Strategic Purchasing and are able to articulate the case for their implementation

- Procurement professionals that are able to talk the language of accountants and so ‘sell’ the principles and process of Category Management and Spend Analysis as being in the self-interest of finance & accounting management