Analyse risk in your supply markets.

Risk analysis is a major part of Procurement and evaluating risks in a supply market is a core element of Supply Market Intelligence (SMI). Previous posts have discussed Procurement Strategy and the role of Supply Market analysis to develop SMI for your organisation. This post considers the framework for risk analysis of a supply market, including the likely responses of a supply market and the use of power.

Understanding your supply markets provides confidence to identify suitable sources of supply for the goods and services required to meet business needs. With this understanding, a Procurement professional can identify a suitable business relationship; define responsibilities and establish performance objectives that reflect reality.

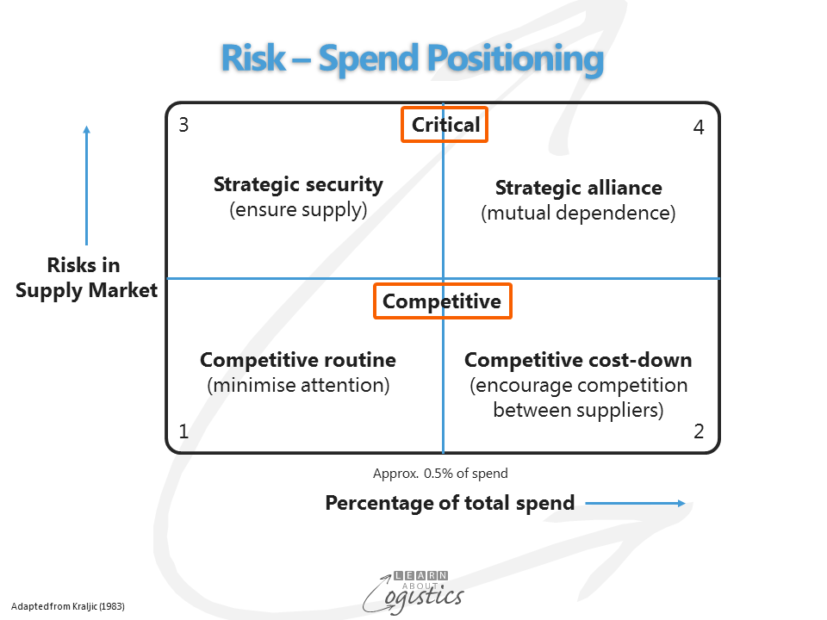

Risk-Spend matrix

The matrix was developed to evaluate the Procurement spend in relation to risks in a supply market.

Although the diagram shows neat quadrants, each quadrant will not be equal. The mid-point for the “percentage of total spend” is about 0.5%.

Risks will be identified in context – a major risk in one context can become minor in another. In Supply Chains, risks are influenced by legal aspects, culture in supplying counties and the risk appetite within the buying organisation and the location of head office.

Approach for each quadrant:

- Quadrant 1 Competitive routine: Buying is a routine process; simplify all processes so that minimal attention is required

- Quadrant 2 Competitive cost-down: Encourage competition between suppliers to reduce total costs; use Procurement knowledge of the market and commodity expertise

- Quadrant 3 Strategic security: Security of supply is more important than purchase price. Develop close relationships with suppliers and remove bottlenecks in the item’s supply chain

- Quadrant 4 Strategic alliance: Develop long term relationships based on mutual dependence between the parties

Power and dependency in supply markets

Power exists where a party can influence another party ‘to do things they otherwise would not do’. Procurement relationships can be affected if a buying organisation is able to exercise power over its suppliers or a supplier exerts power over their customers.

Use of Power occurs where an organisation:

- Owns (or a controlling shareholding) a supplier or customer

- Controls the range of decisions a supplier or customer can make or

- Exerts considerable influence over a supplier or customer to obtain a more advantageous contract (a better deal)

A buyer is able to exert influence over suppliers through:

- The organisation’s buying volume in a supply market

- Exploiting a supplier’s dependency on the buying organisation or a Supply Chain

- Using leverage – promoting the organisation’s brand, reputation, recognition and prestige as a buying ‘lever’

Suppliers can exert influence over buyers through:

- Availability of supply for an item that is difficult to obtain

- Focussed product – incorporating value added services into the product, which cannot be easily duplicated

- Licence from a government to operate

- R&D – providing a continual flow of new products and services that address customer needs

- Reputation and prestige – the ‘best’ supplier for a products or service range

- Technology leadership through patents, copyright and intellectual property (IP)

- Specialised knowledge that restricts the number of potential suppliers

- Spread of customers – suppliers reduce their dependency on large and powerful buyers; some organisations impose a low percentage of total sales that can be conducted with any one customer

In the Risk-Spend matrix:

- Quadrant 1 is unlikely to see power being used

- Quadrant 2 is where buyer power could be used

- Quadrant 3 is where supplier power could be used

- Quadrant 4 is where buyer and supplier have somewhat equal power

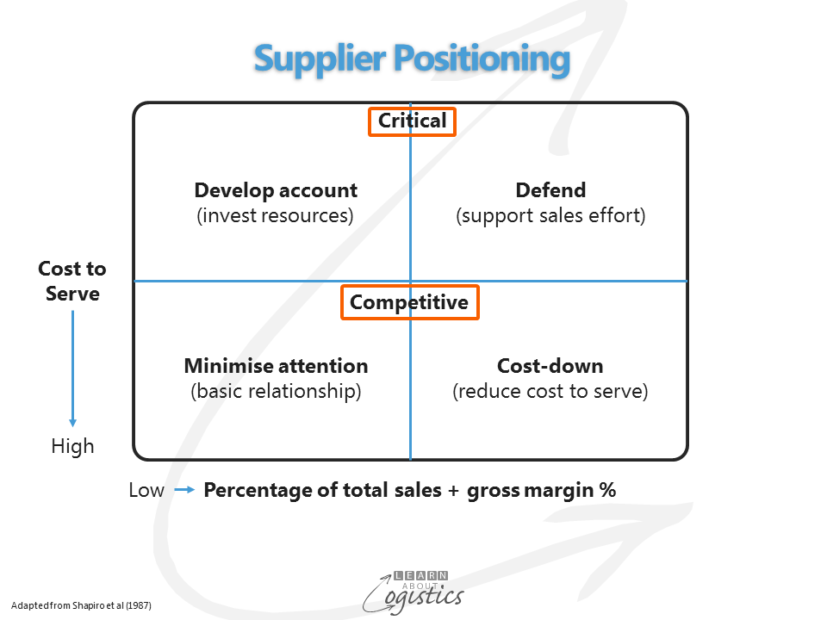

Procurement analysis of likely response by a supply market

In this analysis, the buyer needs to ‘get inside the mind’ of the current and potential suppliers in the supply market to analyse how suppliers may consider the:

- percentage of total annual sales that are (and could be) obtained from the buyer

- weighted by the gross margin earned plus the ‘cost to serve’

- regularity and predictability of the buyer’s expenditure

- ease of replacing the buyer’s business

The response for each quadrant could be:

- Quadrant 1: Minimal attention. Suppliers’ will either maintain a minimal relationship or cease doing business with the customer or client.

- Quadrant 2: Cost down. ‘Cost to serve’ the buyer is high, which affects net profits. Supplier could work with buyer to reduce the ‘cost to serve’.

- Quadrant 3: Develop the account: The supplier can invest resources to develop the account.

- Quadrant 4: Defend. Tactics by the supplier to hold the account could be:

- provide very high levels of customer service

- identify a dedicated account manager

- initiate discussions that could lead to a formal alliance

A preferable response mirrors a buyer’s needs. For example, if the buyer has placed office stationery as Competitive Routine (Risk-Spend quadrant 1), the ideal match is for suppliers to view the buyer’s account as core business to defend (Supply positioning Quadrant 4). In this situation, the supplier is likely to provide a high level of customer service under a period contract.

Conversely, challenges will occur if the buyer considers the supply market will view the account as Minimal Attention (Supply positioning Quadrant 1). Neither the buyer or supplier will put resources and effort into the arrangement.

Using the two matrix adds to the knowledge base in your SMI. This increases the likelihood of building relationships with suppliers and developing a more sustained position in supply markets. This approach is about reducing your organisation’s total cost of ownership (TCO), not reducing supplier prices, therefore your supply market analysis should be evaluated from a broader business perspective.