Disruptions in supply chains

Uncertainty in global supply chains provides a fertile ground for price instability, affected by actions taken by countries or suppliers and potential shortages of products that are essential in the world economy. This requires businesses to understand the potential for disruption in their supply chains and to reduce risks before the need to implement emergency action.

Current events have some countries banning or restricting (through licencing or export taxes) the export and re-export of certain items deemed essential for the country. Others have plans to domestically store imported products. Less noticed is the availability of components or additives required in small quantities to enable particular products to function. For example, the lack of wiring harnesses made in Ukraine, has currently stopped production at some factories of VW and BMW. This provides supply chain challenges in many countries where other components for the vehicles are produced.

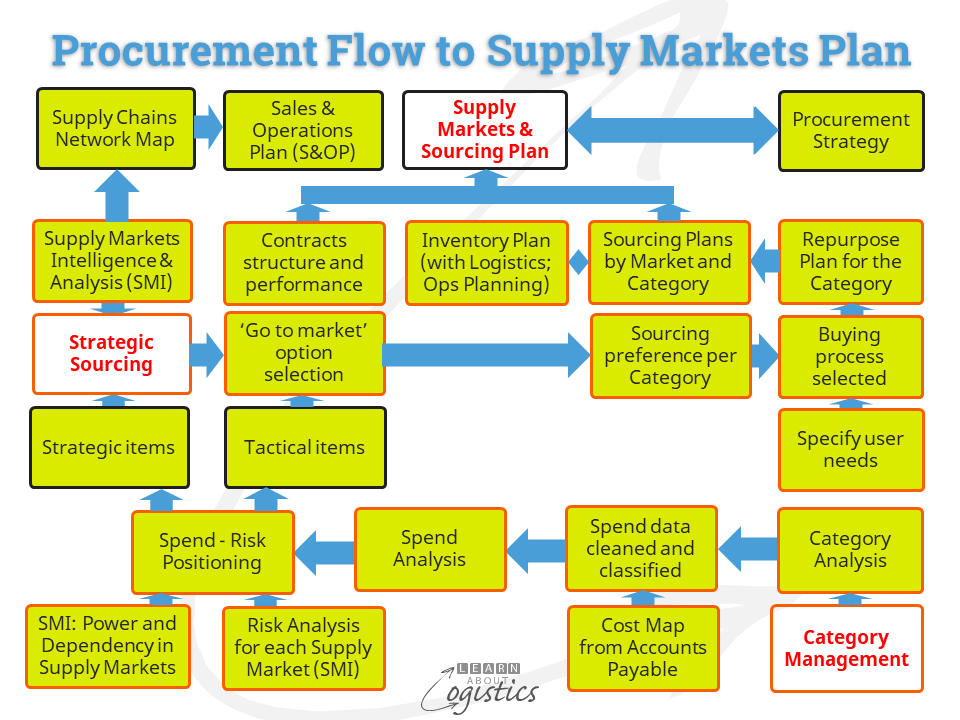

These types of reactions to events that affect supply chains requires your business to develop Sourcing Plans by Market and Category. The diagram below illustrates the linked elements of a Supply Markets Plan as:

- Category Analysis to segment items within a logical structure

- Spend Analysis to evaluate the criticality to the business of each category and the relationship required with the selected supplier(s) and

- Sourcing Plans that evaluate the competitiveness of the supply market for each category of spend

Understanding Supply Markets

The critical role of Procurement within the Supply Chains group, is to enhance an organisation’s supply chains capability, rather than be a price focussed buyer. To achieve this objective requires Procurement to have a thorough understanding of the supply markets they operate within. Each of your supply chains contain two parts:

Core supply chains have contracts and relationships between your organisation and Tier 1 suppliers and customers. A knowledge of the Tier 1 suppliers capabilities is expected.

Extended supply chains are upstream and downstream from Tier 2 suppliers and customers. Typically, a business has no contractual relationship with these entities. Understanding the supply markets that Tier 2 suppliers and below work within requires the gathering of intelligence for each market.

As shown in the diagram, Supply Markets Intelligence (SMI) is an input to Strategic Sourcing. It is the process of identifying the capability of each category supply market that is of interest to a business and establishes the risk profile for a market to use in sourcing decisions. For each supply market of interest, Procurement needs to identify (at least):

Business related intelligence

- Changes in global demand that are possible for the final product produced from item(s) in the supply market

- Substitution possibilities or disruptive technologies likely to change demand in the supply market

- Constraints in the supply market and potential threats related to a material or item, including potential trade limiting or influencing actions by governments

- The influence on final product costs of financial markets, exchange rates and price trends in the supply market

- Potential alternative materials and technology developments currently at the research stage

Supply Chains related intelligence

- Supply Market risks for an item and its critical additives

- Potential delays in deliveries caused by material shortage and transport bottlenecks

- Disaster potential (natural and man-made) and possible effects on deliveries through the supply market

- Number of suitable supplier in the supply market

- Capacity currently available from suitable suppliers

- Share of current capacity controlled by suitable suppliers

- Costs of items built using product breakdown (reverse engineering)

- Pricing policy at suitable suppliers

- Commodity price forecasts

- Barriers in the supply market to a change of supplier

- Logistics capability of suitable suppliers in the market by required geographic region

- Exercise of power in the supply market by particular suppliers and the extent of dependency on the supply market by particular customers

- Security of supply, including country sources risks and ‘conflict materials’ risks (which maybe supplied at Tier 3 or 4) obtained from countries with questionable internal security

Gathering intelligence about a supply market can take many weeks to complete. The project is best led by a specialist analyst (retired librarians and trained analysts are good) and if required, supported by suitable university students undertaking a project. Those in the business who engage across the wider business community e.g. Procurement and Sales will contribute supply markets data and information. However, research concerning individual suppliers is part of each buyer’s job.

The value of information comes from the quality of its source. Government statistics in developed countries can be ranked high. Media and Internet based data is variable in quality and data provided by a ‘friend’ over lunch may be even less reliable (but should not be ignored).

From the assembled intelligence, Procurement professionals can complete a Supply Market Analysis as a structured approach to provide input for the Sourcing Plans. This enables Category Managers to approach Tier 1 supplier(s) with confidence concerning: the potential of suppliers to provide the required item(s) against the organisation’s real needs. Tools that can assist a Supply Markets Analysis are:

- P.E.S.T.E.L (Political, Economic, Social, Technological, Environmental and Legal) analysis supports the ‘big picture’ review of a country, or multiple countries from where items could be sourced and the factors that might influence a supply market decision.

- This analysis is supported by the Logistics Performance Index (LPI) published by the World Bank, which ranks each country’s logistics capability, based on six indicators

- Porter’s Five Forces analysis is for industry level analysis, but its principles can be applied to supply markets, The five forces affecting a supply market are:

- Supply market competitors – extent of rivalry among existing suppliers

- Potential entrants – threats and opportunities from new entrants

- Threat of substitute products or services and/or disrupting technologies

- Negotiating power of key suppliers and their power to influence the supply market

- Negotiating power of major buyers and their power to influence the supply market

Templates and worksheets are available on-line, which can be modified to address supply markets. Also, use the templates and worksheets as prompts to guide ‘brainstorming’ when discussing the analysis.

Supply Markets Intelligence and Analysis identifies potential risks as input to Scenario Analysis. It is also input when considering a new supply contract or to substantiate assumptions about current contracts with Tier 1 suppliers, that contain components or ingredients from particular supply markets.