Procurement structure.

A need to understand the flow of items, money and information for the Supply Chains that connect to your organisation has featured in previous posts. Of equal importance is to understand the markets for items purchased by your organisation; each supply market is a source.

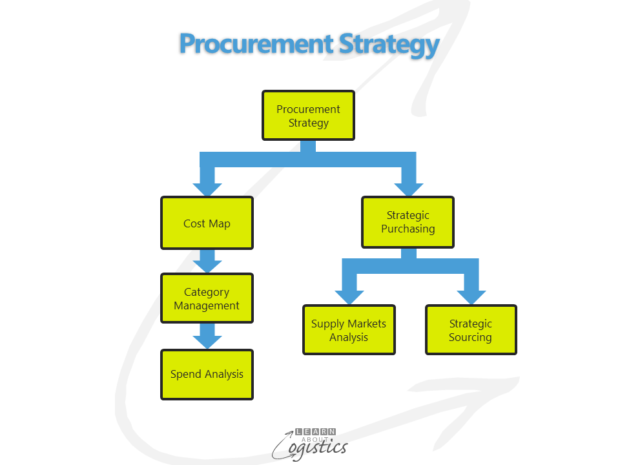

Understanding your organisation’s supply markets is an integral part of the Procurement Strategy – the approach designed to position supplier relationships as a core business strength. The diagram identifies the main elements of a Procurement Strategy.

Cost Map is a corporate level identification of the external purchases, dividing them into Operational materials and services; Non-operational goods and services (fixed, variable and capital) and Expenses (taxes, charges and licences). Each group can be then disaggregated into their respective categories and sub-categories

Category Management is the set of business rules applied to define categories and sub-categories. Examples are within supply market groups – metals, ingredients, packaging etc. or within process groups – logistics services, travel and entertainment, facilities etc. The identification of Categories will vary, depending on the organisation and industry.

Spend Analysis by Category is to identify the structure of the spend, possible improvements in the buying process and importantly, whether an organisation can exert leverage in that category’s supply market

Strategic Purchasing comprises interactions with the supply markets, to understand the current and potential situation and whether the organisation is in a position to influence a supply market. This enables an organisation to approach the supply market with a degree of confidence concerning real needs and the potential of suppliers in the supply market to provide the required item(s)

Supply market analysis provides inputs to Strategic Purchasing, identifying the organisation’s spend/risk position in a market, an indication of suppliers response to customers’ positioning (Supplier Preference) and an analysis of vulnerabilities and risks in that market. Examples of non-Procurement vulnerabilities to be analysed as risks in a supply market are:

- Natural and man-made disasters and their potential effect on Supply Chains

- Trade influencing actions undertaken by governments

- Volatility of financial markets and exchange rates that can affect contracts and supplier viability

- Mergers and acquisitions across borders

- Raw material availability and

- Potential changes in global final product demand that may affect material and component availability

The supply market analysis will provide answers to likely questions in your organisation, such as:

- What is the likely demand growth for the required product or service?

- Are there substitution possibilities or disruptive technologies likely to change the supply market demand?

- Is the number of potential suppliers in the supply market acceptable?

- How attractive are the potential suppliers in a closer business relationship?

- What is the production or service capacity currently available in the supply market from suitable suppliers?

- What share of current capacity is controlled by the possible short-list of suppliers?

- How complete is our (the buyer) knowledge of the product cost breakdown?

- What is the extent of our (the buyer) knowledge of the potential supplier’s pricing policy?

- What is the potential supplier’s Logistics capability by required geographic region?

- What barriers exist that might hinder a change of supplier at a later date?

Strategic Sourcing uses the above information to to identify the approach to a supply market, selection process of potential suppliers the contract strategy and the relationship development plan. Strategic Sourcing can be regarded as making the Purchasing Strategy happen through development of a sourcing plan, produced at the sub-category or item level (e.g. safety glasses, glass bottles, creative advertising or environmental consultancy).

Power and dependency

The information gathered enables an improved analysis of power and dependency in a supply market. This is because Procurement relationships are affected if a buying organisation is able to exert power over its suppliers or a supplier can exert power over their customers or conversely, where there is dependency on a customer or supplier.

An example of power and dependency is where customers extend the payment terms for suppliers. Recently, a global mining company and a major Australian retailer extended their payment terms; the miner to 90 days and the retailer to 60 days (although the retailer sells the items in 22 days from receipt). This has naturally caused suppliers to be upset, but does the ruling apply to all suppliers?

If the miner and retailer have a Procurement Strategy in place, they will have categorised suppliers into different classes – suppliers in a competitive supply market must accept the revised payment terms, while those in a monopoly/duopoly and cartel type situation will be treated differently. For example, it is likely the supplier supporting software for the automated mine systems will be paid net 30 days (or sooner), because they can ‘switch off’ supply; likewise, strategic suppliers to the retailer.

Procurement Strategy enables the discipline of analysis to understand supply markets and therefore structure the ‘best’ deals with selected suppliers, based on knowledge. For suppliers, especially those in competitive markets with low risks for customers, the sales department will need to learn the Procurement Strategy process and so counteract the approaches of customers with knowledge.