A survey of interest

There are many surveys concerning supply chains and their disciplines, with the majority generated by consultants and software companies with a commercial interest in promoting their offering. However, a recent survey report by DHL had a better approach for discussing selected trends within Logistics.

It was reported that responses were from more than 2,500 supply chain professionals across four global regions in six industry sectors, with representation across company sizes and seniority levels. The survey provided some interesting, but maybe obvious, insights about Logistics and the people employed within them.

Insights about Logistics

An important insight, given the ease with which opinions can travel, was that each of the four global regions differed in their order of importance concerning the trends. This indicates that articles and podcasts about supply chains that are promoted in the US are not a reliable indicator for the rest of the world. Also, the importance of developments in trends differs by industry sector. Logisticians must therefore critically analyse the drivers of inbound and outbound supply chains in their industry, country and region to identify the real needs and and challenges, with possible solutions.

Another insight is that efficiency remains a major driver for people working in supply chains, even though customers are not interested in the internal metrics of their suppliers. The measure of most interest to customers is ‘delivery in full, on time, with accuracy’ (DIFOTA), discussed in an earlier blogpost as effective Logistics. Attaining a high DIFOTA result was not mentioned as a driver for supply chains in the report. It therefore appears that the main role of functions within the Supply Chains group remains as the reduction of costs, rather than to add value for the business.

A third insight is that for all the hype around AI, Logisticians are wisely not joining the excitement until the dust has settled and “data quality, governance, and responsible use of guardrails are in place”. This does not mean that analytics are ignored. Available for the past 50 years, their use has, more recently, been enabled by increased capabilities in computer processing speeds, data storage and cloud computing, to provide the ‘enabling backbone’, according to the survey report. However, the survey report emphasizes that “a practical path of scaling proven analytics experience” is required. In addition is the challenge of hiring people with the required data analytics skills.

For Logistics, the report identifies the priority for solutions that enable “traceable, data-rich shipments”. from warehouses and distribution centres. Included are Next-Generation Packaging, Smart Printables and Industrial Internet of Things (IIoT), which “improve cost, compliance, sustainability, are visible to customers and quick to deploy on-site without heavy system changes”. There is also an emphasis placed on “priorities that reduce emissions and align with stakeholders requirements, while strengthening reporting credibility”. These include electrification of vehicles and power generated by renewables (on-site if possible).

The survey report notes that “even when interest is high, respondents often cite costs and limited resources as the main brakes to implementation”. It emphasises that to have a chance of success “multi-site rollouts, data/computer needs and cross-functional changes require a clear ROI and a staged scaling and implementation”. And that assumes there is a lack of competing projects in the organisation.

An approach that ignores trends

A question to consider is whether implementing technologies provide real trends or does it just build the hype? Instead, rather than spend money, time and resources on new things, should the focus for supply chain professionals be to improve effectiveness through simplifying your organisation’s business. This approach helps to identify the real needs of the business.

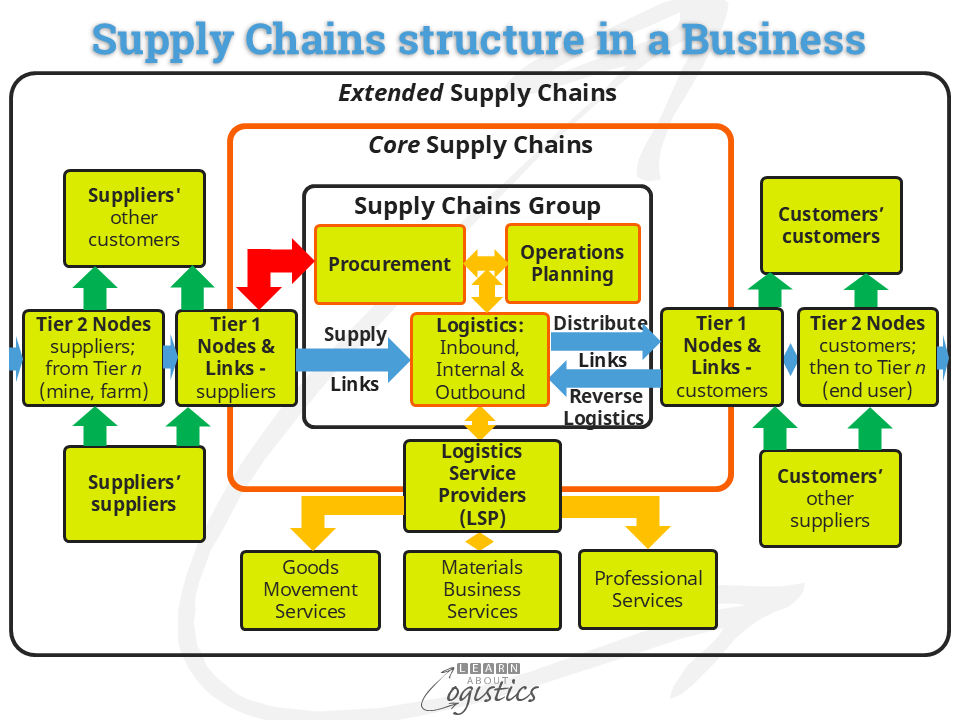

To commence this approach requires an understanding of how supply chains fit into the business, as shown in the diagram below:

The three levels that form an organisation’s supply chains are:

- Supply Chains group (which may currently operate as separate functions in the business)

- Core supply chains, which incorporate the Tier 1 customers and suppliers at Nodes and Logistics Service Providers (like 3PLs) at Links in the Network and

- Extended supply chains out to the end user and suppliers of originating raw materials at farms and mines, in locations that may not be known to your business

Using the Supply Chains structure as the model, knowledge is accumulated about the Supply Chains through the Supply Chains Network Design Map:

- This is based on the Flow Analysis (items, money, data and information) of Nodes and Links, influenced by the objective of your business (efficient, responsive, or agile) to identify critical suppliers in the Core and Extended supply chains. It identifies supplier locations, capabilities, constraints (including transport modes) and risks. The Map should be extended to incorporate Tier 1 customers (at least)

- Supply Markets Intelligence is an input to the Supply Chains Design Map that provides an understanding of the ebb and flow of supply markets.

Sales & Operations Planning (S&OP)

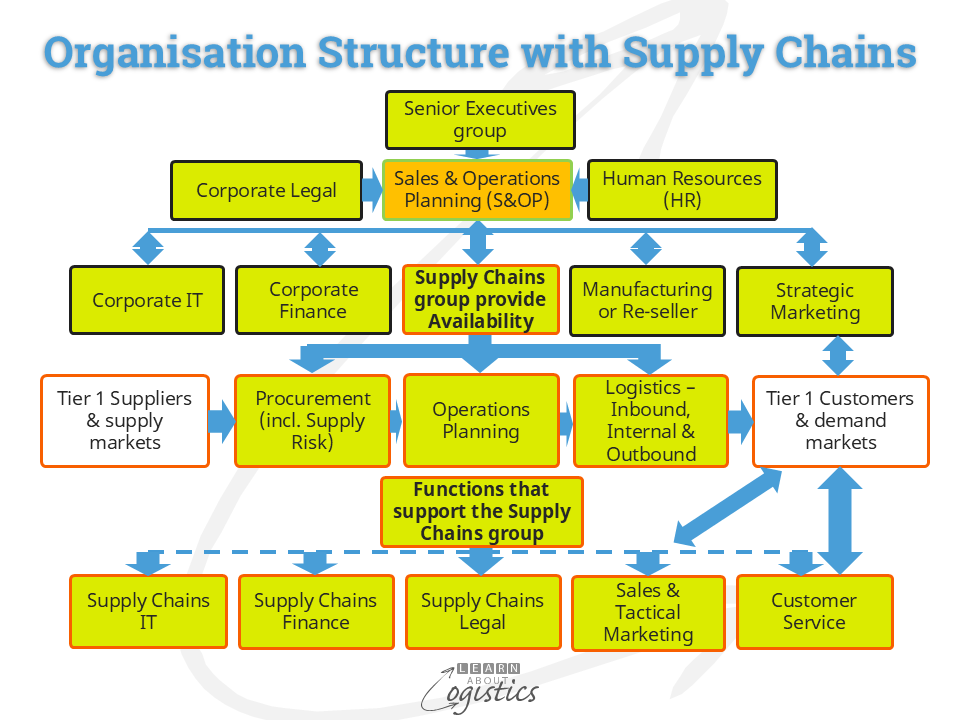

Simplifying the planning of Operations is achieved by implementing Sales and Operations Planning (S&OP), which is a cross-function process to balance demand and supply. It is a business planning process for all functions with a ‘need to know’, not a finance department budget routine.

The diagram below shows that S&OP is the ‘heart’ of the business. Done well, and led by a profit centre manager who believes in the process, S&OP can be an illuminating experience for all.

The profit centre manager is chair of the management group, to ensure a balance between the ‘Sales’ and ‘Operations’ functions within S&OP. Within the process, participants are able to discuss the opportunities and risks associated with demand, supply, capacity and inventory. These discussions define the Risk Appetite that the organisation is willing to accept and the Risk Tolerance for actions proposed by the Supply Chains group to reduce the potential vulnerability to disruptions in the ‘Core’ supply chains.

The S&OP process provides the vehicle to identify three Core supply chains performance criteria for the Supply Chains group:

- Availability of items for customers – achieved through positioning internal and external resources (products, items, people, equipment and suppliers) and measured against the Sales & Operations Plan (S&OP)

- Delivery performance probability target (DIFOTA) and

- Resilience of the business, measured by achieving the Risk appetite and tolerance criteria

Within the S&OP process, all members of the management team are held equally responsible for achieving the Plan. This requires executives to jointly resolve problems and improve the S&OP process, thereby (hopefully) reducing blame through ‘finger pointing’ actions.

Please note: Thank you for reading. The next blogpost from Learn About Logistics will be published on Monday October 27, 2025.