Sales margins under pressure.

Retail shopping power is now said to lay with the consumer using their mobile phone. However, it is the retailer and on-line merchant that dictate the channels available and the price per channel. Will the full cost of Internet shopping be charged to consumers?

Studies have estimated the total cost of the ‘consumer click and retailer pick and deliver’ model in developed countries at about $40 per order It could be half that figure when the order is picked by the retailer’s staff and the consumer collects. To attract consumers, there will always be competitors providing ‘free’ offers for a period of time, so delivery may be free.

Decisions about pricing Internet shopping are underpinned by the expected gross margin for a line item. The more pressure on a retailer to absorb costs in supplying to consumers, then obtaining price reductions from suppliers becomes more urgent. But rather than worry about increasing or maintaining sales margins, it is preferable to put additional effort into improved purchased margins while ensuring your suppliers remain profitable.

Collaboration between organisations

Collaboration is the term used liberally in articles that discuss improvements in Supply Networks and Chains. The term is often used in conjunction with technologies that enable data and information to be exchanged, so that contracting parties are able to make decisions which benefit the relationship and the Supply Chain.

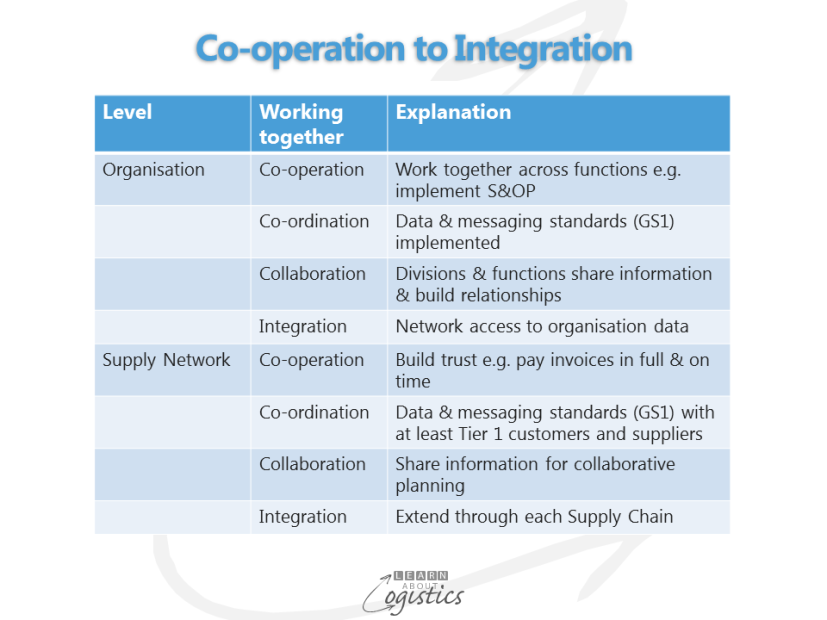

However, for organisations to work more closely together requires three ‘Cs’

- Co-operation of the people involved with the data and information

- Co-ordination through the standardisation of data and systems

- Collaboration through access to the same standardised information

The steps to move from co-operation to integration within an organisation and its Supply Network are:

Collaboration is harder to do than spell. We often read or hear of organisations that promote their ‘collaboration’ with ‘business partners’, when they have not achieved co-ordination of data within their own organisation – beware of the hype!

This is especially so when performance measurements reflect winning. The common starting point in commercial negotiations is ‘you take the risks and I take the rewards’. And, an established practice by powerful buyers is to focus on deductions and penalties against suppliers, rather than on mutually creating value.

The steps to achieving collaboration in Supply Chains are similar in any business relationship where items are involved.; retail has been used as an example of the challenges.

Steps to collaboration

Achieving co-operation is step one towards collaboration; obtained through building trust with suppliers. To commence, implement a policy to pay suppliers in full and on time, which means net 30 days or better. Using suppliers to provide the buyer’s working capital is not an avenue for improving relationships. The second action is to change the penalty regime of powerful buyers into an improvement regime, with the focus on achieving ‘clean’ transactions through all steps in the ordering and delivery process.

A part of achieving co-operation is the customer providing information about their inventory. Suppliers must be able to access accurate inventory that reflects the actual situation – as deliveries are received and orders are picked and delivered.

Together with accurate inventory is improved accuracy of the customer’s sales forecasts. Accuracy is measured at two levels:

- For all line items (SKUs) in an inventory category, the mean absolute percentage error (MAPE) measure is used. Forecast error is a statistical term denoting the difference between the forecast and actual. The MAPE percentage is the difference between the total forecast and actual sales for the inventory category divided by actual sales, multiplied by 100

- For individual SKUs use the Tracking Signal. This is calculated as the cumulative variance (forecast minus actual sales) for a number of periods, divided by the standard deviation

For best results and to focus on improvements, the MAPE and Tracking Signal use inventory categories identified within the extended ABC inventory classification approach, called the ‘coefficient of variation’ (CoV). This is part of the more analytical and systems approach to inventory management (policy, planning and control) and forecasts that need to be implemented in organisations.

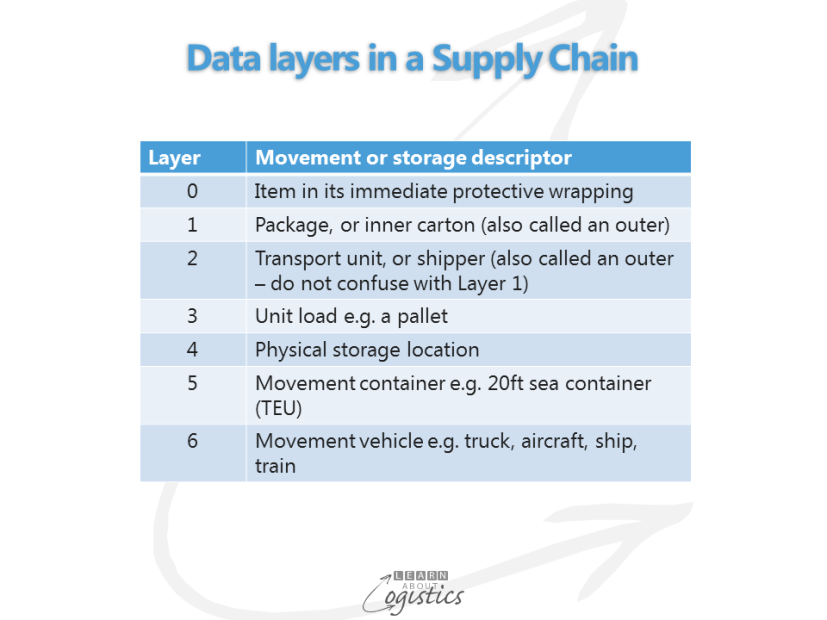

So, co-operation has got more to it (and could take longer) than might be supposed. Next comes co-ordination; this requires implementing GS1 global standards for the collection and transmission of item data, between parties in a Supply Chain. To be effective and efficient in the collection, collation and use of data requires the electronic reading of product and non-product descriptors through six data layers in a Supply Chain.

With the Supply Chain data and information of your organisation available to members of the Supply Network, they not only need access, but also to directly incorporate the data and information into their planning systems. For this to happen requires your organisation to operate a private data network.

This article has outlined that before your organisation can use the collaboration word, there must be at least six building blocks in place. It is not a five minute task, but implementing collaboration to a plan makes it easier to explain to staff and suppliers (and to customers if they are in a receptive mood) what is being done and why.