Global trade and increased complexity.

Global trade continues to increase, together with the length of trade routes, increasing the complexity of supply chains. This in turn, increases the reliance that shippers have on their logistics service providers (LSPs), that can change the power structure in supply chain relationships.

There is an old saying which states ” It is not the person digging for gold that makes the money, but those who sell the shovels”. In international trade, its the shippers who are digging for gold, with LSPs selling the shovels. As multinational corporations (MNCs) expand their supply networks, these will increasingly be held together by the activities of LSPs. But as the reliance increases, consolidation of the LSP industry continues into fewer and larger operators and concurrently, the capabilities of LSPs in far distant areas will become more important to shippers.

This will provide a challenge for logisticians in the future – do they contract with large LSPs, but with less choice of provider, or negotiate with LSPs across the world, requiring a larger supply market analysis and contract management effort? This decision will be made in light of increases in the amount to be spent with LSPs; the World Trade Organisation (WTO) estimates that global import and export merchandise trade will be about $70 trillion within the next ten years, having increased from U$12 trillion in 2008.

How much of this increase in trade will move between the current hubs for production and distribution? With such an increase in trade, where will the new growth hubs be established and will the location decision be decided my MNCs or by LSPs? These questions are asked because much of the increase in global trade will be between related parties; that is between divisions and affiliates of MNCs. Although comprehensive data is not available, global trade between related parties is estimated to be currently about one third of all trade, with some countries (e.g. Sweden and Australia) having more than fifty percent of their international trade occurring between related parties.

The roles of LSPs

But how much is understood about the global LSP industry? In my discussions, the term logistics service provider (LSP) is rarely used, because many people in business and government do not know what it means. Instead the term third party logistics, or 3PL is in common usage. 3PL means a third party to a contract between two principals – the buyer and seller. The third party is the organisation that will store, transport and distribute the goods. This is typically a domestic or in-country function and restricted to warehousing, road transport and distribution.

But there are many other logistics activities undertaken by a myriad of businesses that relate to the supply chains of sellers and buyers.

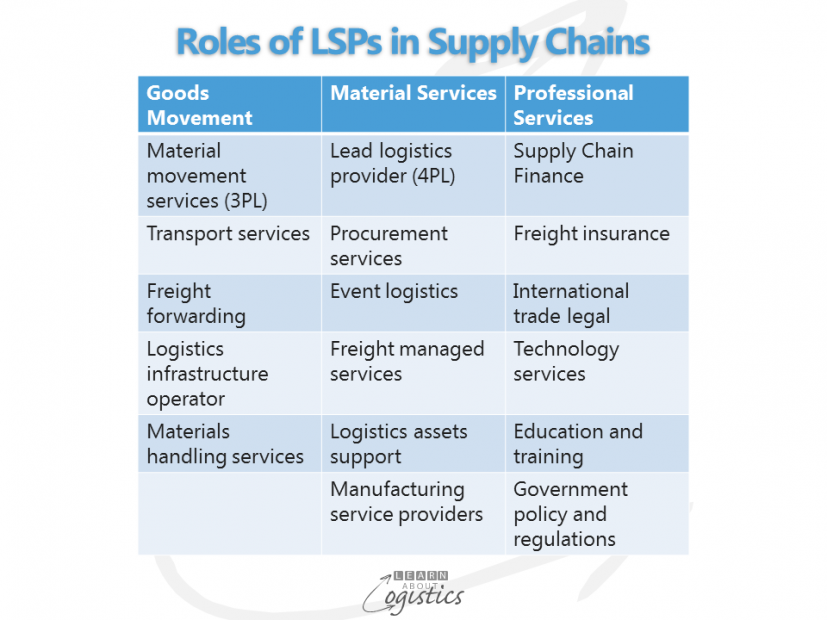

In the chart, the various LSP businesses (and there could be more) are divided into three categories – goods movement, material services and professional services. This helps to distinguish the essential service that is provided and is the first step in identifying how important each LSP is to your business.

The first step is to segment your LSPs into categories and sub-categories:

Category: Goods movement

Sub-category: Materials movement services (also called 3PL) includes:

- Distribution: can include pack and label (also called store ready merchandise); quality inspection and testing; final assembly

- Order fulfilment, including less than carton picking in e-commerce situations

- Home delivery

- Warehousing and storage, including bond stores

- Reverse logistics – the return of items from end users for repair and recycling

Sub-category: Transport services includes: road, rail, air sea and inland waterways; Courier, Express and Parcel (CEP) services

Sub category: Freight forwarding includes Customs brokers

Sub-category: Logistics infrastructure operator includes:

- Inter-modal transfer services

- Freight handling services at: airports, seaports, container terminals and parks

- Dense Trade Clusters including: logistics cities, inland ports, freight hubs, logistics villages, freight activity centres etc.

Sub-category: Materials handling including: pallet hiring, bulk bins, secure wrapping, strapping systems etc.

Category: Material services

Sub-category: Lead logistics provider (also called 4PL) – the consolidator of total logistics services for a client

Sub-category: Procurement services including: supply market analysis; sourcing; purchasing; disposal; eProcurement

Sub-category: Event logistics including concerts, exhibitions and trade shows

Sub-category: Freight managed services including:

- Transport consolidation

- Ship and aircraft brokering and chartering

Sub-category: Logistics assets support including: maintenance services of logistics (materials handling) equipment

Sub-category: Manufacturing service providers including:

- Original design manufacturer (ODM)

- Contract manufacturing (CM)

- Product design services

Category: Professional services

Sub-category: Supply Chain Finance including:

- Location and tax advice

- Commodity futures market services

- Financing suppliers – using their accounts receivable (called Factoring)

- Financing suppliers – using buyers accounts payable

- Financing inventory

- Trade finance

Sub-category: Freight insurance including risk management advice

Sub-category: International Trade legal services

Sub-category: Technology services including: supply chain and logistics software applications; logistics IT and communications hardware

Sub-category: Education and training including: universities; vocational colleges; private providers

Sub-category: Government policy and regulations by ministries and departments

Applying your business rules

Using a set of business rules applied against each category, sub-categories, LSPs within a sub-category can be assessed, based on criteria, such as the value of services purchased, the number of potential suppliers and the capabilities required. This analysis will provide the potential impact, financial and reputation risk to your business.

LSPs that operate on a global basis will have exposure to more risks than a local road transport business, but will also have access to resources that mitigate the risks. An example of risk exposure with global LSPs is the degree of co-ordination required between the IT systems of materials and product suppliers, contracted LSPs and your business. Shippers ideally wish to have visibility and control over events in their supply chains, together with LSPs that perform to contract. However, the lack of systems integration is likely to mean that problems cannot be addressed in the desired time-frame. In this example, the risks have increased, requiring a more expensive risk mitigation action plan than if systems integration (or even co-ordination) was good.

When the analysis is concluded, it is likely that the LSP suppliers with the higher risk profile will show they are either more critical to your business, or are candidates to be replaced. Implementing this analysis approach can provide your business with a better understanding of the current relationship situation, but also the likely changes and challenges in the future as your business and that of LSPs increases.